Bron

MSCI

The world’s publicly listed companies must dramatically accelerate climate action if the 1.5°C warming target set out in the 2015 Paris Agreement is to be met, according to a new quarterly Net-Zero Tracker published by MSCI, a leading provider of critical decision support tools and services for the global investment community.

The inaugural Net-Zero Tracker highlights how the annual emissions of listed companies globally are still at the same level as 2013, despite concerted efforts to place climate change at the top of the global agenda. This includes the 2015 Paris Agreement which set a goal to limit global warming to below 2°C, with 1.5°C the preferred target.

Specifically, the MSCI Net-Zero Tracker highlights that listed companies:

- Collectively emit 10.9 gigatons* of direct greenhouse gases every year, as of May 31, 2021

- Need to stay within the remaining emissions budget of 61.4 gigatons of carbon-dioxide equivalent (CO2e) to avoid breaching the 1.5°C threshold

- Would deplete the remaining emissions budget in less than six years, without any change to their current emissions

Henry Fernandez, Chairman and Chief Executive Officer, MSCI, comments: “For the net-zero revolution to be successful it is critical for investors, companies, financial intermediaries and policymakers to come together to divert the world onto a path towards a sustainable future. Despite the rhetoric since the 2015 Paris Agreement, more immediate action is needed. The MSCI Net-Zero Tracker is a progress report for whether the world can keep the global temperature rise below 1.5°C. Listed companies and other capital market participants have less than six years to meet that target. “In addition to listed companies taking action to drive the transition to net-zero, there needs to be a reallocation of capital by asset owners and an effective channelling of funds by asset managers and banks. This will help reduce the risks of climate change for the world as we all play our part to avert a climate catastrophe.”

The MSCI Net-Zero Tracker provides a quarterly gauge of climate change progress across a global universe of 9,300 publicly listed companies based on the MSCI All Country World Investable Market Index (MSCI ACWI IMI). The Net-Zero Tracker will bring new levels of transparency to investors and policymakers regarding listed companies’ action on climate, providing aggregate progress on temperature alignment as well as highlighting industry leaders and laggards. The latest report shows that:

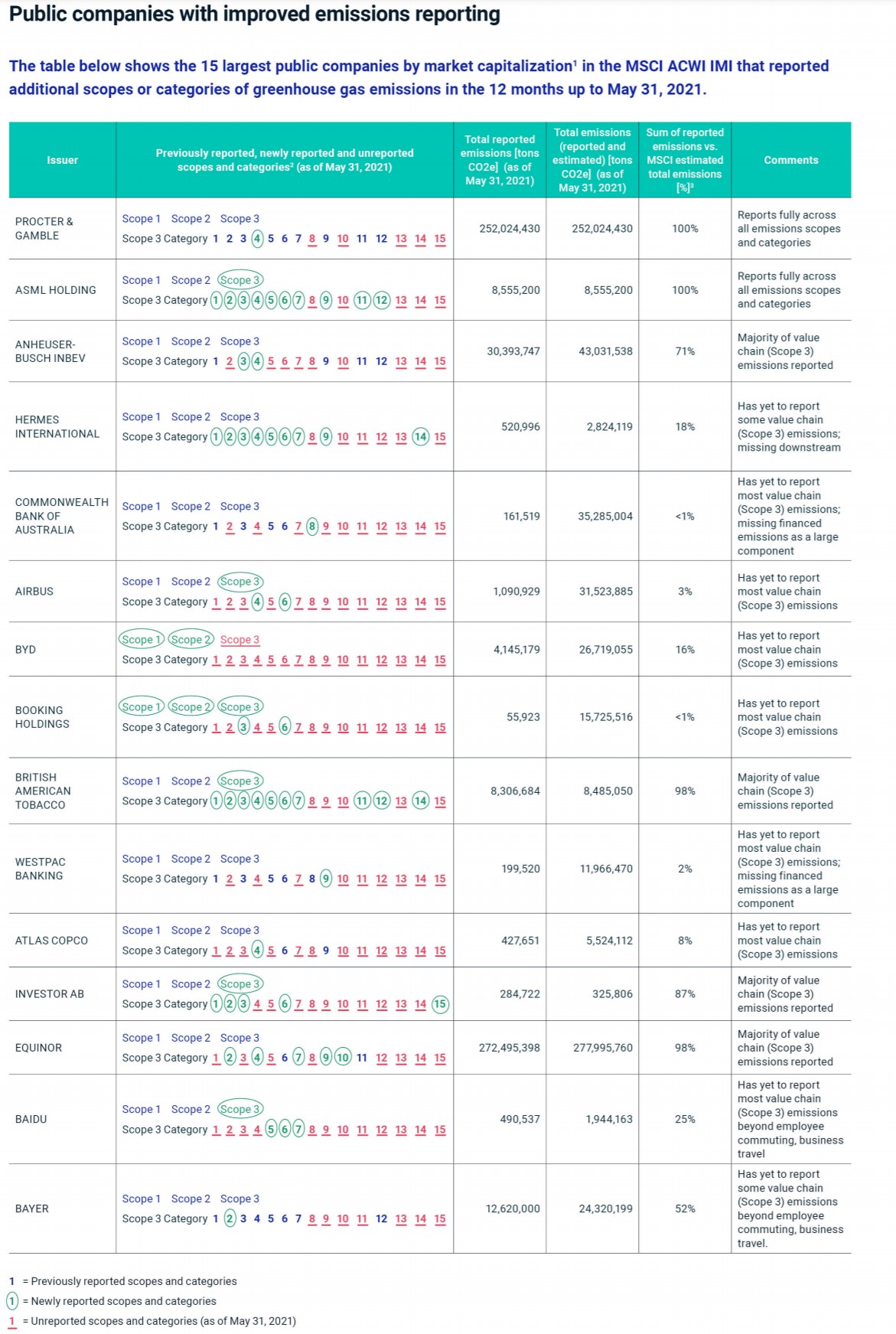

- A number of well-known publicly listed companies reported their indirect (i.e, Scope 3) emissions for the first time, including, Airbus SE, Baidu, Inc., and British American Tobacco plc, but not all the disclosures are comprehensive

- Westpac Banking Corporation and Booking Holdings Inc., the operator of Booking.com, KAYAK and OpenTable, reported only a small proportion of their total direct and indirect emissions

- The Procter & Gamble Company and ASML Holding N.V. both reported additional scopes in the previous quarter, to now report all company emissions across most of the relevant categories (i.e, Scope 1, 2 and 3)

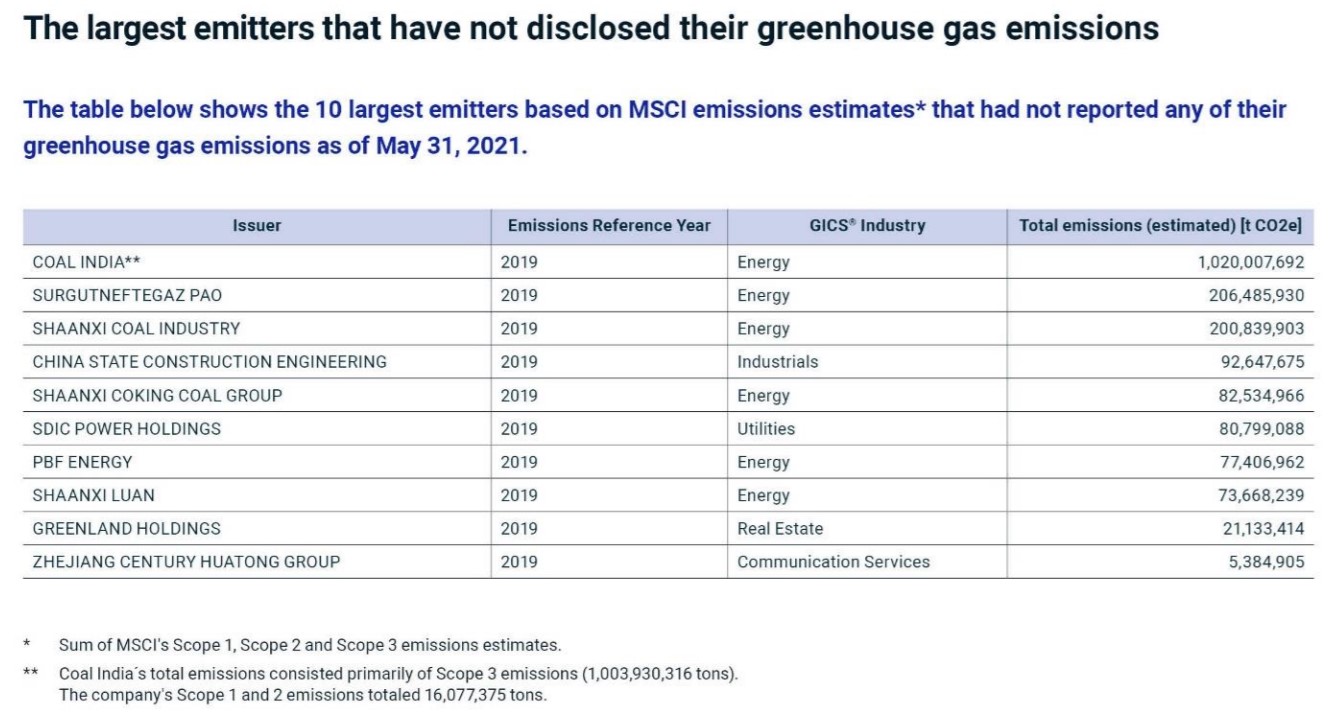

- Coal India Limited was the largest emitter not to report any of its greenhouse gas emissions

Remy Briand, Global Head of ESG and Climate at MSCI, adds: “The MSCI Net-Zero Tracker is bringing a new level of transparency to the climate debate. It will allow investors to monitor whether listed companies have credible plans to reduce their carbon footprint and track the alignment of their own portfolios with the 2015 Paris Agreement. The data in our inaugural Net-Zero Tracker shows the need for a dramatic acceleration in action from the world’s public companies. For those not matching their commitments or lagging, there should be nowhere left to hide.”