Would you like to make a positive impact through your investments? We argue that investors in listed securities who want to encourage more sustainable corporate behaviour should invest in green bonds.

What are green bonds?

Green bonds are defined and qualified by a clear “use of proceeds” (UoP) pledge by the borrower to allocate the funds borrowed into projects to meet specific environmental objectives, including climate change mitigation and adaptation. This makes it easier for investors to identify and provide funding to companies based on their future intentions, rather than on their historical record on sustainability.

Fixed income generally — and green bonds specifically — play a vital and immediate role in funding the transition to a low carbon future. For example, financing energy companies (possibly the worst polluters) that have made clear commitments to transition out of fossil fuels can be potentially very impactful. Not only do green bonds create important incentives, which can contribute to changing behaviours and business practices over time, they also provide the necessary funding for companies to do so.

Governments and companies are paying ever greater attention to the current trajectory of carbon emissions and are allocating capital into projects that deliver environmental benefits. With a growing numbers of investors seeking to finance the right companies, green bonds should enjoy strong support through increased portfolio allocations in the future.

A Small but Rapidly Growing Market

Yet, challenges remain, including the harmonisation of impact reporting methodologies, as well as the relatively small size of the green bond market itself, relative to the overall fixed income market. This can restrain the ability of investors to access and trade green bonds, which is a particular issue for very large investors.

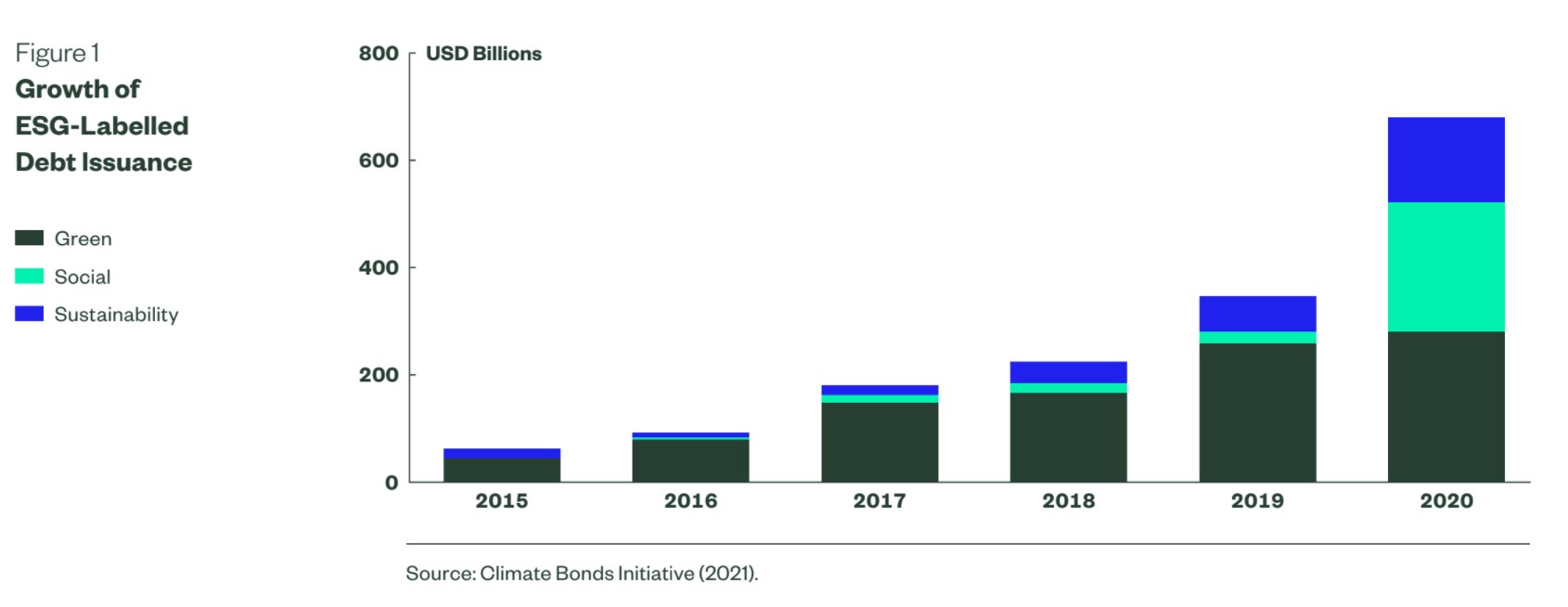

New green-labelled issuance remains akin to a drop in the ocean compared to the volume of outstanding regular debt. Despite having slowed somewhat during the COVID-19 market disruption, the total issuance of green-labelled bonds rebounded in the second half of 2020 to reach a record-breaking $290bn by the end of December, compared to $267bn in 2019. The COVID-19 pandemic immediately impacted the issuance of all types of bonds in March 2020 but this subsequently led to an acceleration of issuance of new sustainable and social debt markets. For the first time, there was a large increase in instruments being issued with a pandemic-related UoP. This contributed to a ten-fold increase in the volume of social bonds compared to 2019.

New regulations and policy changes are also creating opportunities for private sector investments in Europe and a more diverse range of borrowers are coming to the market. For example, European car manufacturers including Volkswagen (€2bn), Daimler AG (€1bn) and Volvo (€500m) have all issued debut green bonds in 2020 as they transition their production toward electric vehicles.

The Climate Bonds Initiative predict $450–500 billion of new green-labelled bonds in 2021 and $300–$500 billion of other labelled bonds (such as sustainability-linked bonds and transition bonds). Consequently, the ESG-labelled bond market may cross $1 trillion of labelled new issuance in a single year for the first time.

While growth has accelerated, a big challenge has been that the green-labelled bond opportunity set remains very small relative to the outstanding bond universe. Yet, investors ask us “how can we make our portfolios more climate aligned, while still balancing the risk-return impact?”

No investor can ignore their return objectives, just as they cannot ignore ESG impact, risks and opportunities. The green-labelled bond market is small to the extent that even with the growth of the market in recent years, investors are wary of how its inherent risk characteristics and return profile may change materially given the magnitude of the projected growth relative to the existing market. So, investors are rightly asking “what are the options?”

The Role of Green Bonds in Funding the Climate Transition

Meeting the Paris Agreement goals requires not just the greening of select sectors but the transition of the entire global economy to an emissions pathway that is aligned to net zero carbon by 2050. This requires significant effort and enormous capital commitments. The OECD estimates that for infrastructure alone, the additional investment needed amounts to at least $6.9tn a year.1

The climate finance gap requires every capital source available, but could largely be bridged through the capital markets, especially the largest segment — the $100 trillion bond market. Green bonds are a vital and immediate way for companies to fund their transition and for investors to directly plug into some of the financing required to urgently decarbonise the global economy. More than 1,300 entities have already issued just under $1.2 trillion worth of bonds whose proceeds are ring-fenced to financing projects, assets and activities that seek to generate positive environmental impacts. There has been a surge of net zero aspirational pledges and initiatives recently. Once set, climate targets, usually require external financing.

Green bonds are well-understood and transparent instruments that can help companies move closer to alignment with the Paris Agreement in numerous ways. To qualify, the issuer must first conduct an internal assessment to establish a green bond framework that defines eligibility criteria, how projects are selected, how outstanding proceeds will be managed and how it will report on the UoP, and importantly the impact of these green investments. This gives companies a better view and understanding of climate-related risks2 and how they can manage and mitigate them.

Further, green bond issuers have commented positively on the closer integration of various internal departments, including finance, sustainability or core operations, as a result of their green bond issuance — a collaboration that would not otherwise taken place, and that can unlock the delivery of more efficient corporate transitions or even transformations. The market has already witnessed several prominent examples of this phenomenon, such as the Danish energy company Orsted (former Dong Energy).

Orsted funded a lion’s share of its shift from a fossil fuel power company into a renewable energy pure play with green bonds. Industry peers EDF, Enel, Iberdrola have done the same, with labelled green issuances reportedly resulting in emissions savings equivalent of as much as 43% of their interim 2030 reduction targets.3 Similar moves have been made by companies in different sectors, with the automotive industry providing ample recent case studies via maiden green bonds from Kia, Volvo, Volkswagen and Porsche.

Investors can be faced with the choice between bonds from two companies, one with relatively low current emissions but no investment plans, and another with relatively higher current emissions but aggressive and credible future plans to lower them. An asset allocation strategy based exclusively on current ESG scores derived from historical data would not only underperform an alternative strategy that takes account of forward-looking information, it would also risk failing

to fund the very investments required to tackle climate change. The biggest rewards will fall to investors who are first to adjust their core exposures towards those heavy-polluting bond issuers that are making clear commitments to transition to becoming credibly green.

Why a Sustainable Climate Bond Strategy Should be in Your Core Allocation

As investors explore options to transition the core of their fixed income portfolio into debt financing a lower carbon economy, we argue that green bonds are an excellent option. However, they may have other constraints and need to cast their net wider, for example, for diversification or risk-return target requirements that are consistent with their strategic benchmark (such as the Bloomberg Barclays Corporate Bond Index).

If companies are proactively transitioning to net zero emissions, but have not specifically issued a ‘green-labelled’ bond, why would a climate-aware investor not want to invest in them? Undertaking this approach increases the investment opportunity set, giving investors a far greater choice of which bonds to buy.

For a climate thematic investment approach, there are two key elements that investors should consider in their framework:

- Reduce carbon intensity and fossil fuel exposure

- Have a means to examine companies and identify those that are aligned and/or making progress in their transition to net zero

In our Sustainable Climate Bond Strategy, we typically buy green-labelled bonds in the primary market. Prior to each investment decision, we evaluate green bonds ensuring that the requirements are in harmony with the Green Bond Principles4 and that are expected to qualify for inclusion in the Climate Bonds Initiative database. The ESG-labelled bond market remains somewhat limited, relatively basic and voluntary, which is why organisations such as the Climate Bonds Initiative (who State Street Global Advisors partners with) are vital.

Just because a security is identified as green or even ‘dark-green’, doesn’t automatically qualify it to be eligible in the sustainable climate investment universe, and in some cases we may actively avoid certain issues. For example, for our latest suite of Sustainable Climate Corporate Bond Index Funds, the green-labelled bonds that we will not buy are those where the issuer also fails to meet certain norms-based ESG screens, such as violating the United Nations Global Compact principle.

Investing based on ESG ratings alone can lead to investors prioritising “leaders” over “laggards”, with little attention given to those companies that need to transition the most to deliver on the goals of the Paris Agreement. Well-functioning capital markets centred around impact finance, which incorporates the use of green bonds, is absolutely vital if we are to overcome these challenges.

Benchmarked to the flagship Bloomberg Barclays US, Euro and Global Corporate Bond Indices, the new State Street Sustainable Climate Bond Funds utilise a mitigation and adaptation framework of screens and tilts to achieve climate-based investment objectives. State Street Sustainable Climate Bond Funds apply skilled sampling to deliver a diversified investment exposure while also incorporating top-down and bottom-up reference targets which immediately reduce investors’ carbon emissions and fossil fuel exposures significantly, avoids exposure to companies associated with severe ESG controversy and commonly screened ESG issues, while also reallocating capital to green bonds and companies identified as companies playing a bigger part in the low-carbon transition needed to achieve net zero by 2050.

This new fund range therefore enables corporate bond investors to immediately set the direction and ambition for their climate-based investment goals, while also aligning with the goals of the Paris Agreement.

Rupert Cadbury, Fixed Income Portfolio Strategist State Street Global Advisors