Societal issues have gained prominence in recent months as the ongoing pandemic has led to skyrocketing unemployment and exposed cracks in healthcare provisioning. This development is reflected in the increase in social bond issuance – bonds that raise funds for social projects – and in the creation of so-called Covid bonds that seek to remedy the issues spotlighted by the pandemic. The EU’s recent entry into this market as part of its employment recovery programme and its ambition to develop a social bond taxonomy could serve as a positive tipping point in terms of growth. At present, the lack of clear reporting standards still represents a hurdle that issuers need to overcome.

Covid-19 pandemic has spurred swift rise in social bond issuance

The social bond market has witnessed a flurry of activity this year as a result of the Covid-19 pandemic. In the past, proceeds of social bonds were mostly used for social housing projects and job creation. This year, issuers – particularly agencies and supranational organisations – have used them to help mitigate the impact of the coronavirus. Recently launched social bonds have targeted employment preservation and generation, medical supplies and equipment, rehabilitation, healthcare-related infrastructure, and research and development for medicines and vaccines.

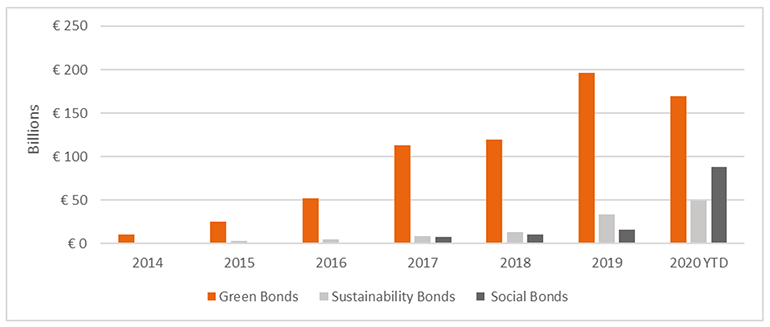

The urgent need to respond to the Covid-19 crisis boosted the social bond market to EUR 125 billion as per the second half of October. Given that this market stood at only EUR 35 billion at the end of 2019, this represents a tremendous increase, allowing the social bond market to surpass the sustainability bond market[1]. In response to the heightened interest in social bond financing, the International Capital Market Association (ICMA) updated its Social Bond Principles in June 2020 and expanded the list of eligible project categories and target populations[2].

Figure 1: Annual issuance of green, sustainability and social bonds

Source: Bloomberg, NN Investment Partners (22/10/2020)

Source: Bloomberg, NN Investment Partners (22/10/2020)

The European Union has also joined the ranks of social bond issuers as part of its efforts to tackle the impact of the pandemic. Recording by far the largest order book of EUR 233 billion by a sovereign or SSA (supranational, sub-sovereign and agency) issuer, the EU issued a dual-tranche inaugural social bond: 10y (for a maximum of EUR 10 billion) and 20y (EUR 7 billion). The proceeds are earmarked for its employment recovery scheme, SURE.

The EU has distributed the proceeds to three countries: EUR 10 billion to Italy, EUR 6 billion to Spain, and EUR 1 billion to Poland. These countries can use these funds to finance a share of their new borrowings, allowing them to borrow at lower costs than if they were to issue in the primary market themselves. In the grand scheme of things, this is just a first step. More financing will be needed to tackle social challenges as well as climate mitigation and adaptation to meet the 2030 goals of both the Paris Agreement and Sustainable Development Goals (SDGs). Therefore, we also expect to see individual governments, including the aforementioned SURE beneficiaries, coming to the primary market, though at present with a greater focus on environmental than social challenges.

Capital market participants positively welcomed these new EU issuances, given the beneficial features of the bonds. EU is a supranational entity with a sound credit profile, hence its solid triple-A rating. EU bonds are 0% risk-weighted, LCR level 1 eligible[3], and benefit from privileged treatment under Solvency II. The issuance’s eligibility for the ECB bond purchase programmes (the pandemic emergency purchase programme and the public sector purchase programme) further heightens its attractiveness. In terms of pricing, the 10-year bond was priced at 3 bps over mid-swaps, while the 20-year bond priced at 14 bps over mid-swaps. The bonds provided a new issue premium of 1 and 2 basis points, respectively.

As a follow-up to this initial issuance, the EU targets a social package amounting to EUR 100 billion within the upcoming year. Furthermore, it aims to finance almost a third of the recovery fund with green debt, making itself a dominant player in the global market for green and social bonds. With the bloc planning to ramp up bond issuance in the coming months as part of its recovery scheme, this high level of investor interest should serve as a preview of what is to come.

What comes next for social bonds?

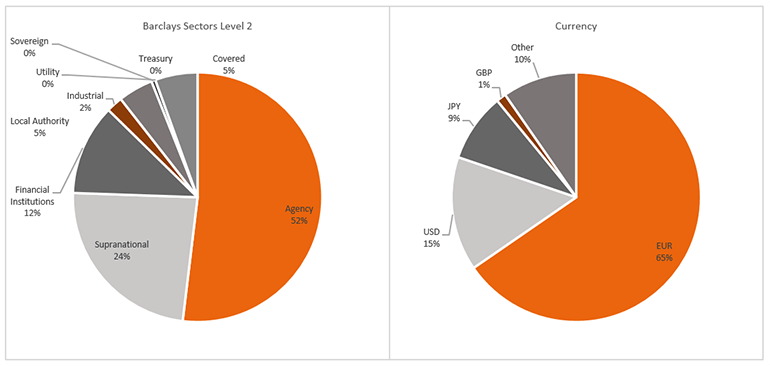

The pandemic is far from over, and social concerns surrounding employment preservation and healthcare will remain pivotal to the recovery. Given this, coupled with the high levels of investor interest, we see room for the social bond market to expand and diversify further. Still, the usual suspects will likely remain the main issuers – agencies, supranational organisations and financials. Currently, they comprise 52%, 24% and 12% of total market share respectively (see Figure 2). The majority of social bonds are euro-denominated; with the EU’s ambition to penetrate the market, this should remain the case or even increase.

Figure 2: Current market composition

Source: Bloomberg, NN Investment Partners (22 October 2020)

Source: Bloomberg, NN Investment Partners (22 October 2020)

This expansion could push the market into a new stage of growth, even after the pandemic is behind us. The European Commission has recently taken the initial steps towards the creation of a social taxonomy that would complement its green taxonomy, announcing the formation of a working group on the topic. Such a development could further encourage a broader range of market participance to enter this space. For instance, corporate issuers that wish to address fundamental social issues across their businesses and supply chains could increasingly seek financing via social bonds. At present the corporate social segment is a long way behind the green bond market, where corporate issues account for almost half of the total market and are increasingly diversified, with issues from a broad spectrum of companies.

The risk of socialwashing

With the continued growth of the social bond market, we cannot discount the risk of socialwashing – in other words, issuers neither providing reliable information on projects and projects’ social performance nor aligning their issuance with a long-term strategic view to tackle social aspects of their core business. Social bonds are self-labelled instruments, and until the European Commission publishes the first draft of its social bond taxonomy, one of the biggest challenges for the market remains the lack of a standardised impact reporting framework. Although green bonds are also self-labelled, this market by now boasts a range of taxonomies such as the EU taxonomy, the CBI taxonomy and the ICMA Green Bond Principles. At present, the social bond market has only the Social Bond Principles.

This lack of clear standards makes it more difficult for both issuers and investors to determine the eligibility and success of projects. For instance, even now although the EU aims to report on the “number of jobs and number of companies covered/supported” by its SURE-related social bonds, there are as yet no taxonomies that could provide guidance on the projects’ key performance indicators and eligibility. Any such disclosures will depend on the reporting of the individual member states that benefit from the bonds’ proceeds.

On top of this limited market guidance on social bonds, issuers have come to the market this year without any proper documentation or engagement with investors. At the time, the urgent need to respond to the pandemic justified the lack of social bond framework or second-party opinion. If these practices continue, however, this would complicate the task of assessing the eligibility of the underlying social assets as well as the issuer’s intentions of aligning its social bond issuance with its general sustainability strategy.

Overall, social bonds represent a liquid form of impact investing and tackle areas that green bonds overlook. Therefore, social bonds might become a viable option for investors wishing to shift their portfolios towards positive social impact. The development of the EU Social Bond taxonomy is expected to further enhance the market’s breadth and liquidity.

As our green bond portfolios run purely green strategies, we do not hold social bonds in our green bond portfolios. However, within our other fixed income strategies, we do invest in social bonds on a case-by-case basis. Throughout the investment process, we analyse all potential investment opportunities on relative value. When a green or social bond is available with the characteristics that we are looking for and offering the same risk/return profile as a traditional bond, then we would prefer the green or social bond. We will continue to pay close attention to the rapid development of the social bond market as well as to the EU’s social bond issuance, as the bloc will be a prominent issuer over the coming years, given the need to finance its recovery fund.

Jovita Razauskaite, Portfolio Manager Green Bond NN Investment Partners (NN IP)

[1] Sustainability bonds are bonds whose proceeds finance a mix of green and social projects.

[2] https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/June-2020/Social-Bond-PrinciplesJune-2020-090620.pdf [3] Level 1 assets are those that are the most liquid under the liquidity coverage ratio (LCR).