With the Green Finance Framework (GFF), the Volkswagen Group today presented further guidelines for sustainable financial instruments. In future, it will therefore be possible for investors to invest in a targeted fashion in sustainability projects of the Volkswagen Group such […]

lees meer

NN Investment Partners (NN IP) introduceert een nieuw fonds: NN (L) Corporate Green Bond. Het nieuwe fonds is een aanvulling op het bestaande assortiment en gebruikt dezelfde strategie als NN (L) Green Bond, maar is specifiek gericht op groene obligaties […]

lees meer

Marktcijfers bevestigen dat een groeiend aantal beleggers belangstelling heeft voor groene obligaties. NN Investment Partners (NN IP) heeft de indexperformance over de afgelopen vier jaar geanalyseerd en is van mening dat markten voor groene obligaties in een bredere obligatiecontext moeten […]

lees meer

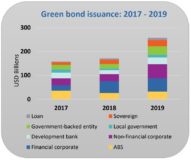

The Climate Bonds Initiative published its Green Bonds Market Summary 2019. Global green bond and green loan issuance reached an adjusted USD257.7bn in 2019, marking a new global record. The total is up by 51% on the final 2018 figure of USD170.6bn. Of the […]

lees meer

Global green bond issuance is expected to be between $300-$375 billion this year, after a record year last year, according to research from two companies who track the growing market. Green bonds are a category of fixed-income securities that raise […]

lees meer

De heropening van de Nederlandse Groene staatsobligatie ‘DSL 0,50% 15 januari 2040’ heeft onlangs een bedrag van € 1,195 miljard opgebracht. De storting vond plaats op donderdag 16 januari 2020. De Deens pensions administrator PKA heeft voor 20% van dit […]

lees meer

De Nederlandse Staat wil op 14 januari 750 miljoen tot 1,25 miljard euro ophalen met de heropening van een groene obligatielening. Dit meldde DSTA, het agentschap van het ministerie van financiën. Het betreft de heropening van een groene lening met […]

lees meer

A new record was set in 2019 for the volume of sustainable debt issued globally in any one year, with the total hitting $465 billion globally, up a remarkable 78% from $261.4 billion in 2018. Last year also saw all-time, […]

lees meer

The Climate Bonds Initiative has released Version 3.0 of the international Climate Bonds Standard, a significant development for global green bond and loan markets. Sean Kidney, CEO of Climate Bonds Initiative said, “The Climate Bonds Standard now underpins certification of over USD100 […]

lees meer

On December 12, 2019, 6 pm CET, the Green Assets Wallet, an innovative blockchain database, where issuers and investors of green bonds meet, will be launched. A co-creation of leading capital market actors, green finance experts and technology innovators, the […]

lees meer

Nasdaq announced the launch of the Nasdaq Sustainable Bond Network (NSBN), a global platform that aims to increase transparency and accessibility to environmental, social and sustainability bonds. Nasdaq formed the first Sustainable Bonds Market in 2015, and NSBN enhances the sustainable bonds’ […]

lees meer

Euronext today announces the creation of a new Euronext Green Bonds offering across its six regulated markets. The initiative, which was launched today at Climate Finance Week in Dublin, is operated out of Euronext Dublin, the group centre of excellence […]

lees meer