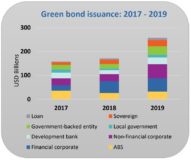

The Climate Bonds Initiative published its Green Bonds Market Summary 2019. Global green bond and green loan issuance reached an adjusted USD257.7bn in 2019, marking a new global record. The total is up by 51% on the final 2018 figure of USD170.6bn. Of the total, USD10bn (4%) are green loans. The 2019 volume was primarily driven by the wider European market, which accounted for 45% of global issuance. France leads Europe, followed by Germany, Netherlands. For comparison Asia-Pacific total cumulative (inc China, India) is $176bn. Asia-Pacific and North American markets followed at 25% and 23%, respectively. In 2019, the total amount of green bonds issued in Europe increased by 74% (or USD49.5bn) year-on-year, reaching a total of USD116.7bn.

Report Highlights