Bron

Climetrics

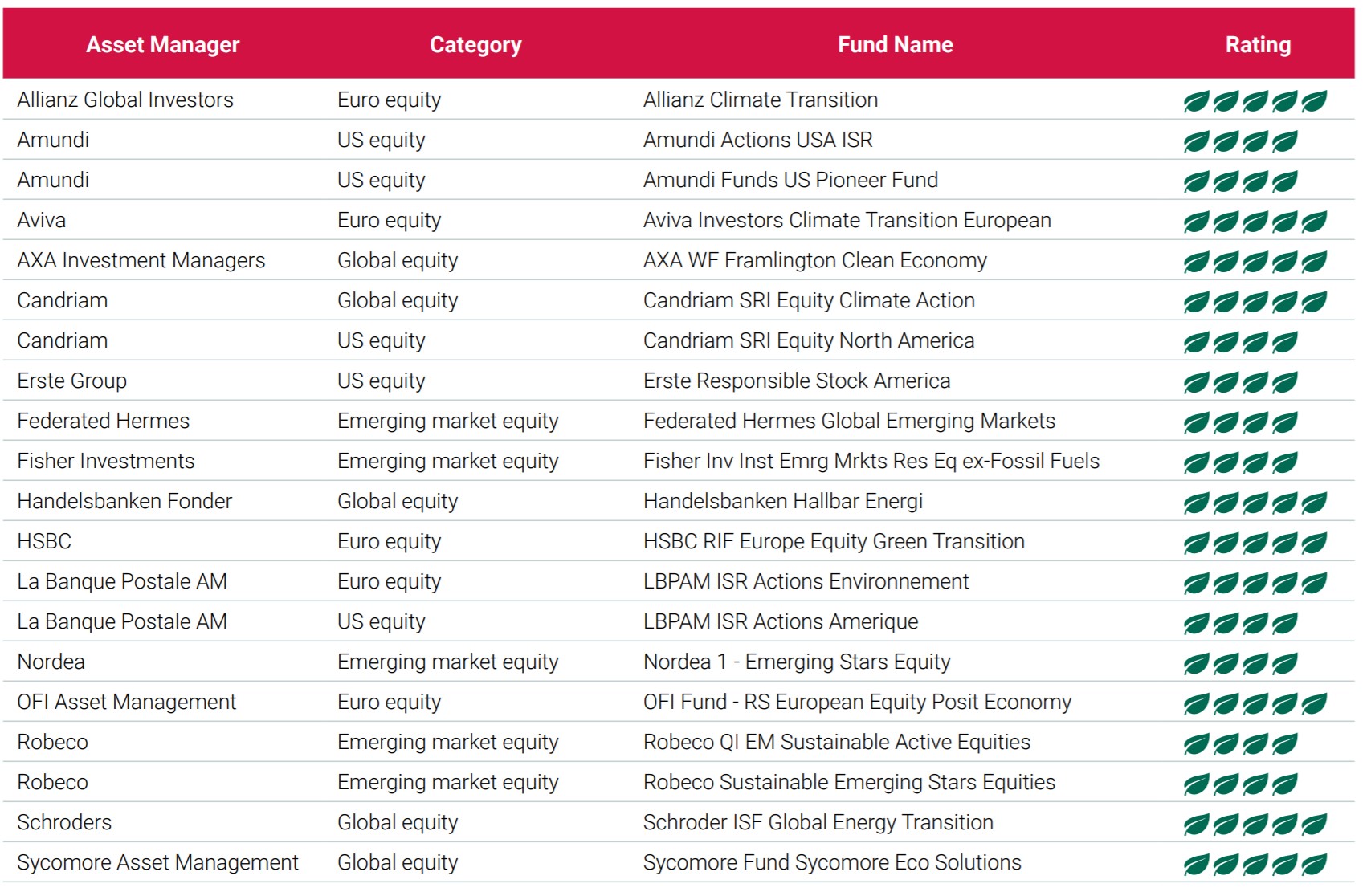

Twenty equity funds from sixteen asset managers are recognized today as the top environmental performers at the CDP Europe Awards, hosted by the European Investment Bank. The ranking of funds across the European, global, emerging markets and US equities asset classes is based on data from the climate rating for funds, Climetrics. Climetrics rates 20,000 global funds – around one third of the total global mutual fund market – and publishes free-to-search ratings on a scale of ‘1-leaf’ to ‘5-leaf’. Any investor can use it to search funds that are well-positioned in the transition to a low-carbon, water-safe and deforestation-free economy. The rating is offered by non-profit charity CDP, which runs the global environmental disclosure system, and ISS-ESG. Asset managers Amundi, Candriam, La Banque Postale Asset Management and Robeco each have two award-winning funds, while French asset managers received over a third of all awards, underlining the leading role of French investors and asset managers in the transition to a low carbon, more resource-secure economy. In the US equity award category, 4 of the 5 awards were won by European asset managers.

The top five actively managed funds for each equity category were selected based on their underlying Climetrics score. In the global equity and European equity categories, all funds are rated the best ‘5-leaf’, while in the emerging markets equity and US equity category, the highest fund rating given was ‘4-leaf’.

The EU had $1 trillion in AUM in sustainable funds in 2020, compared with just $179 billion in the US.[2]

Climetrics Fund Awards results

Asset managers Amundi, Candriam, La Banque Postale Asset Management and Robeco each have two award-winning funds, while French asset managers received over a third of all awards, underlining the leading role of French investors and asset managers in the transition to a low carbon, more resource-secure economy. In the US equity award category, 4 of the 5 awards were won by European asset managers.

The awards are distributed during the CDP Europe Awards, a high-level dialogue hosted by CDP and the European Investment Bank and produced by Euronews, Europe’s most-watched news channel.

Nico Fettes, Head of Product Development at CDP Europe, said: “Easy-to-access transparency about funds’ environmental performance, provided by Climetrics, enables the industry to step up and fuel the transition to a net-zero emissions, resource-secure economy. We urgently need a faster shift in capital towards the companies with sustainable business models and clear transition plans in line with 1.5°C of warming. The funds winning this year’s Climetrics Fund Awards are investments that are better vehicles for investors looking to drive the low-carbon transition.”

Climetrics uses a best-in-universe approach and calculates how well companies in a fund’s portfolio disclose and manage material risks and opportunities related to climate change, water security and deforestation, which are key concerns for financial markets. It also assesses the asset manager’s own governance of climate issues and its investment policy.

The rating emphasizes transition finance: it gives better scores to funds investing in green technologies or in companies with good management of material climate, water and forests-related risks. This includes, for example, companies from high impact sectors that have a science-based target to reduce emissions in line with 1.5°C.

This approach enables investors to easily find diverse funds with good environmental performance and helps channel capital faster to the low-carbon transition.

All top-rated (5-leaf) funds are run by asset managers demonstrating strong climate action through participation in collective corporate engagement initiatives and good climate-related disclosure.

5 of the 16 winning managers – AXA IM, Handelsbanken, Nordea, Robeco, and Schroders – are part of the newly-launched Net Zero Asset Managers initiative, a $9 trillion group committed to net-zero aligned investment by 2050.

The full results are published here (pdf).

Magdalena Wahlqvist Alveskog, CEO Handelsbanken Fonder, said: “Investments in future solutions, as well as companies transitioning to more sustainable operations in line with the Global Goals, are both of considerable importance to our entire organisation. We are grateful and proud to have received the Climetrics Fund Award for Hållbar Energi, an acknowledgement of our long-standing belief that sustainability and profitability go hand in hand. Our aspiration is to create value for future generations.”

Christine Clet-Messadi, lead portfolio manager at Allianz Global Investors, remarked: ““We are honoured to accept this award from the CDP. Global warming is a major sustainable development issue with a potential to impact the economic models, growth and risk profiles of companies across different sectors, and investors are now at the forefront to help companies transition to a low-carbon economy. Launched ahead of the Cop21, Allianz Climate Transition aims to support European companies that are best equipped to tackle climate change”.

The winning funds generally invest in companies which disclose better climate, forests and water data to CDP, show a comprehensive awareness of material environmental risks, and are investing in leading practices like setting science-based targets and transitioning to 100% renewable energy.

These are the third annual awards for Climetrics-rated funds, and the first time that US equity funds are included.

Climetrics rates nearly 20,000 funds every month representing €16.8 trillion, around 32% of the total assets of the global investment fund industry. The database is free-to-search at www.cdp.net/en/investor/climetrics