Investments in the environmental, social and governance-based (ESG) landscape are expected to remain on a growth trajectory in 2021. According to the research data analyzed and published by ComprarAcciones.com, ESG funds, also referred to as sustainable funds, will double this year. More than 12% of investors who do not invest in ESG currently are expected to move the market, driving the uptick.

Growth in related funds will continue even in the coming years as an additional 17% of investors plan to move to ESG funds in 2022 or thereafter. Per the report, 40% of investors who will not invest in ESG funds in 2021 or 2022 will do so in the future. Only 30% of investors do not have any plans to invest in ESG funds at all.

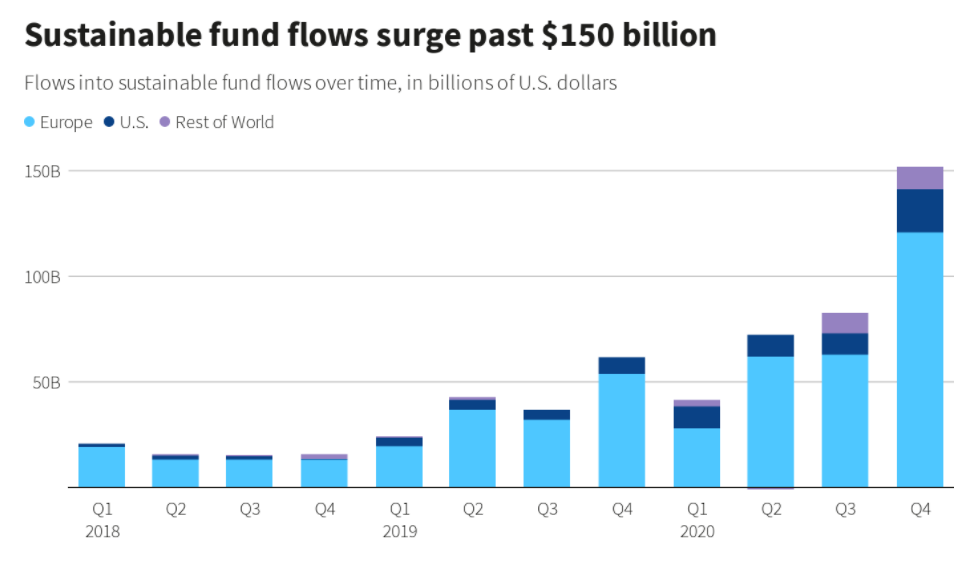

According to industry tracker Morningstar, there was an incredible upsurge of funds into ESG in 2020. Assets under management in the sector shot up to $1.7 trillion by the end of the year following a 29% uptick in Q4 2020.

The increase was attributed to a stimulus-driven recovery of the market as well as investors’ search for more resilient investments. There is an accelerating push from governments around the globe for a shift to a low-carbon economy. This has resulted in a change in tax regimes and market rules to favor climate-friendly investments. It has also given rise to the belief that companies with a good ESG score will post better performance over time.

As a result of the strong demand in the sector, funds flowing into ESG funds shot up by 88% in Q4 2020 to $152.3 billion.

Asia’s ESG-Related Funds to Grow by 20% in 2021

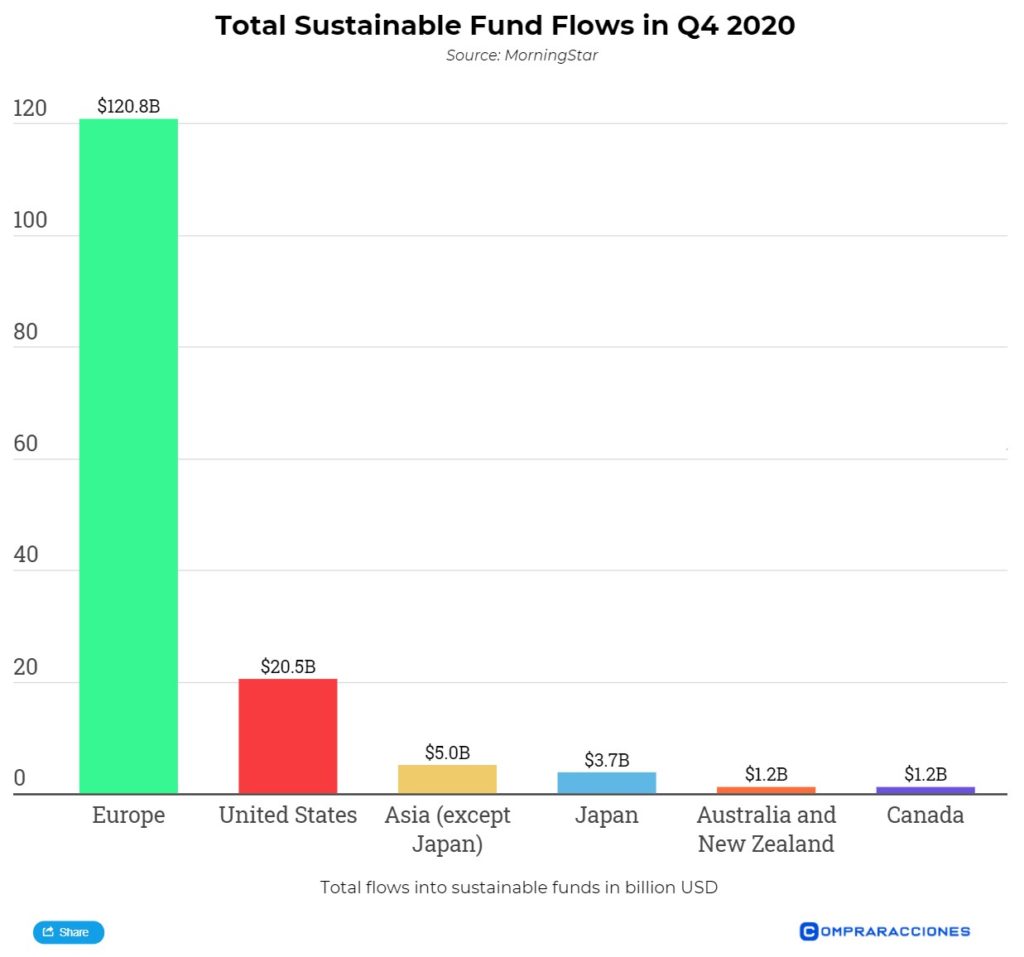

Europe-domiciled funds dominated the global charts in Q4 2020, accounting for close to 80% of total inflows ($120.8 billion). The United States was second, contributing $20.5 billion or 13.4% of the net. Funds across Asia, New Zealand, Canada and Australia amounted to a collective $11 billion.

Japan is the top country in Asia, accounting for approximately 80% of the total ESG funds trading on exchanges. According to Bloomberg Intelligence, their total value amounted to $40 billion for the whole of 2020. China, on the other hand, holds a share of about 10% of this total.

Notably though, China is expected to lead the growth on the continent. Over the past two years, ESG assets under management in the country shot up by 1,700%.

Additionally, Bloomberg Intelligence analysis projects that in 2021, China will contribute to a 20% growth in Asian ESG funds. Its dominance is attributed to the country’s push for electric vehicles and renewable energy, which will spark additional fund flows into the sector.

Lending credence to this projection, JP Morgan also forecasts that Asia’s sustainability funds which doubled in 2020, will double again in 2021.

South Korea, Japan and China are among countries that have committed to achieving net zero carbon emissions. China’s target for reaching carbon neutrality is the year 2060 while South Korea and Japan are targeting 2050.

JP Morgan highlights that in order to achieve its target, China will have to cut its reliance on coal. From the current share of 60%, coal use should drop to 2% or 3% while renewable power capacity should grow significantly. In the next five years, China’s solar power generation will double.

China is currently rated as the world’s top greenhouse gas emitter, accounting for a 28% share of worldwide emissions. Its emissions are higher than those of the US and the European Union combined.

US ESG Funds More than Doubled to $51 Billion in 2020

According to CNBC, citing Morningstar data, new investments flowing into ESG funds in 2020 hit a record high of $51.1 billion in the US. That was more than double the amount recorded in 2019 and the fifth consecutive year of record annual growth.

In 2019, investors poured in about $21 billion into related funds. As of 2020, investments in sustainable funds accounted for about 25% of all money flowing into stock and bond mutual funds. That was a remarkable jump from a mere 1% in 2014.

According to Refinitiv, US-based assets under management that mandate ESG factors rose by about $5 trillion within the past two years. Among the factors contributing to the growth is a growing interest by younger generations in issues like climate change. Moreover, investors have a wider range of options than ever before.

In 2020, US investors had access to over 400 sustainable funds, up by 30% from the previous year. It was a near fourfold increase over the previous 10 years.