Impact investment is rapidly growing. Why? What are the developments? And how does this business pushes towards the transition to a sustainable and inclusive society? In 6 articles we will highlight the developments, opportunities and risks of Purpose & Impact investment. This is the fourth article about understanding the developments of Green, Social and SDG bonds, the reasons to issue and the rationale to invest in these type of bonds. Discover the opportunities ahead with combining reputation efforts and ESG performance; doing good with corporate financing.

In 2006 Mohammed Yunus received the Nobel Prize for making microcredits big. It was not the Nobel prize for the economy, but the Nobel Prize for the most prestigious category: Peace. It made clear that the Nobel Committee saw that Impact Investments matter. To lend money to private small businesses might be a way out of poverty for people. Doing good with ‘corporate’ financing. Today microcredit is under scrutiny as it has grown from a social investment method towards a money-making machine.

To borrow money from investors by private companies is as old as there are banks. Various forms exist, the biggest and public available form are bonds. The total global bond market is estimated by OECD in 2018: 600-800 billion USD. Recent years interesting development emerged: There is a rapid growing interest of investors in impact investing (more on this in article 2 of this series) resulting in companies borrow money from investors to improve their companies Environmental, Social and Governance (ESG) performance. It’s called Green Bond or Social Bond and it’s big. In 2019 alone a global value of 257.5 billion USD was issued, estimations argue that in 2020 this will reach over 1 trillion USD. Really what we call ‘marcrocredits’. And different from the early microcredit, as it’s not a social investment but an impact investment with a low risk and rate.

Development COVID and Bonds

There are various types of Impact Bonds. The most common ones are Green Bonds: a loan to an organisation for investing in environmental benefit. Next to Green Bonds there are Social Bonds, Social Impact Bonds, Sustainable Bonds and even Sustainable Development Goals (SDG) Bonds. The common denominator of these type of bonds is doing good and earning a return rate. The outlook over 2020 shows a sharp increase of the number and value of Green Bonds and a slightly increase of Social Bonds, while Sustainable and SDG Bonds are considered smaller.

COVID-19 was a disrupter in many ways. While the growth of Green Bonds still is growing fast, Social Bonds went through the roof and is growing with double digits. Many governmental issuers seek to finance their social policies with bonds. From a private sector perspective, companies follow with Google (Alphabet) as they issued a record of 5.75 bn USD in August 2020 of Sustainable Bonds. CFO Ruth Porat quoted from her blog: “Google’s products have improved the lives of people all over the world and the use of proceeds of this Sustainable Bond aims to do just that”.

Midsized companies and their Bonds

While the values are high, the amount of Green and Social Bonds are relatively low. In 2019 there were 1788 Green Bonds from 496 issuers globally according to Climate Bonds Initiative. The credit rating of an issuer seems to be the key: with a BBB or higher rating this type of financing is suitable for an organisation. Major issuers are (semi-) governmental institutions, which have a high credit rating.

But things are changing. Smaller sized businesses are starting to issue <10 mio EUR Green or Social Bonds. As large institutional investors are not really interested in bonds <100 mio EUR, other investors and financing types are entering the bond markets. It’s still small in terms of capital, but the rates are higher (just as the risks). We consider this as a positive trend, many midsized businesses are seeking investments for a sustainable transition. This should be promoted not only for financial growth ambitions, but also for the sustainable transition which impact investment enables.

Washing up a company

Issue an impact orientated bond stating to ‘do good’ with the received funds, while in the execution powered by the bond less positive societal impact is created. This is referred to as ‘green washing’, ‘social washing’ or ‘SDG washing’. Read more in article 3 of this series. The Dutch Financial Authorities (note: The Netherlands is number 5 of the global Green Bond market) is warning for this washing practices in its recent report. As the market is growing and not maturing at all, this is what bothers all investors and regulators the most. How to be sure the use of proceeds is really ‘doing good’?

The example provided earlier of the Sustainability Bond of Alphabet has met the Green Bond Principles 2018 and Social Bond Principles 2020, such standards can provide an answer if the bonds are really ‘doing good’. The future seems to be determined by the EU Taxonomy, a sophisticated set of rules and standards which enables transparency on sustainable financing and probably will be used outside the EU too. This will not solve the ‘washing up’ problem. It will just give you soap. Investors and issuers should use the soap accordingly.

Part of the transparency is controlling the green or social claims. An issuer should prepare itself, not only on paper, but in reality, for a solid ESG process and a solid use of proceeds. A third party conducts a review of the ESG processes and the use of proceeds. This could be seen as a light version of an external audit. Based on the information provided by the issuer an assessment of a bond is performed, which gives an investor more assurance that there is no ‘washing up’. This all will lead to the maturing of the Green and Social Bond markets which is needed mostly for the midsized companies wanting the enter the market.

Source: Deschryver & De Mariz 2020

Why should a company issue Green or Social Bonds?

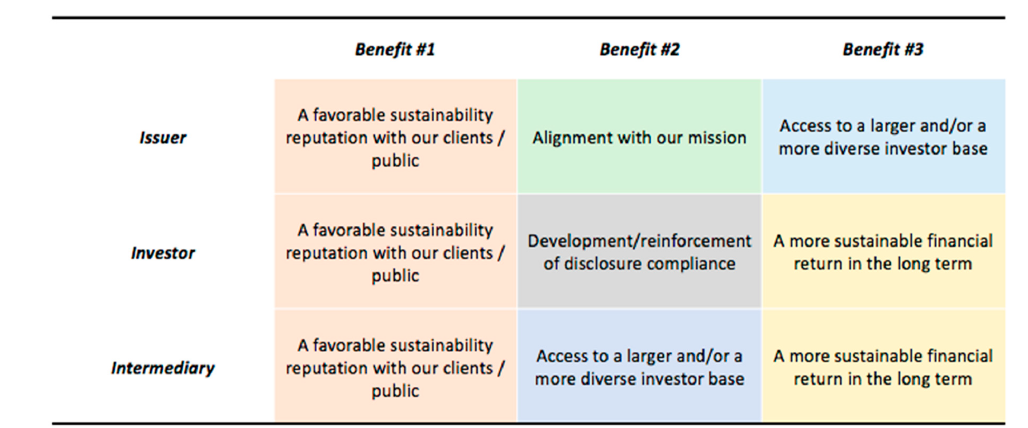

It seems more hassle to issue a Green or Social bond then a regular bond. An organisation should prepare itself by setting a strong ESG process, make sure the use of proceeds is indeed used for green or social purposes and report on the impact if the bond is in place. Research shows that communicating about the sustainable efforts of either an issuer or an investor leads to a better reputation. And a better reputation leads directly to a better company’s performance on all aspects.

High ESG performing companies are outperforming their peers as we have seen in article 1 of this series. The ESG performance of an organisation issuing a Green or Social bond is in general high. This can only lead to an outperforming business, while doing good with corporate financing.

About the authors

Martin de Jong is founder of Empact, impact consultancy and working for (international) clients on Societal Strategy, ESG and Impact Valuation. He is former director Societal Value VodafoneZiggo and Sustainable Business Manager Vodafone PLC. He is guest lecturer on various universities on sustainable business.

Anne Rademaker is founder of Rademaker Consulting and working with strategic partners (both public and private) to accelerate the transition to a global circular economy. Anne is working with Martin for Empacts ESG & Impact clients. She is a former Senior Consultant at EY with extensive knowledge on Finance, Risk and Process management.

More info on Empact.