Impact investment is rapidly growing. Why? What are the developments? And how does this business pushes towards the transition to a sustainable and inclusive society? In 6 articles we will highlight the developments, opportunities and risks of Purpose & Impact investment. This is the second article.

While most organizations focus on the negative effects of risks (such as reductions in revenue), this is the time to grasp the opportunities that these risks might bring. There is growing interest from investors seeking to understand how organizations are identifying and responding to ESG-related risks. However existing risk assessment tools might not be set-up to manage correct assessment and consequently management of ESG risks. For instance, the traditional criteria “likelihood” and “impact” does not provide room for more important aspects such as velocity or resilience. We believe that risk mitigation should be quantified, monetized and analyzed with a 10-year scope, in order to really understand the value of a risk and transform a risk into an opportunity.

The ultimate balance of risks and opportunities

Risk management is hot and gaining an increasing prominent stage in board rooms. According to COSO’s Enterprise Risk Management, a risk is “the possibility that events will occur and affect the achievement of strategy and business objectives.” This includes both negative effects (e.g. reduction in revenue) as well as positive effects (meaning opportunities). Most public and private parties face an evolving landscape of Environmental, Social and Governance risks (“ESG”) related risks and have limited time to explore and grasp potential opportunities here. As there is no universal definition of ESG-related risks (and often is referred to as sustainability, non-financial or extra-financial risks) it’s well known that these risks can impact a companies’ profitability, success and even survival. For instance, physical risks arising from climate change are likely to cause unprecedented disruptions to supply chains across industries. And as COVID-19 shows short term social (health) risks which are likely to show have a disruptive effect on society and many businesses. We believe that companies must start preparing and managing these risks in a structured manner to protect both revenues and reputation. This approach suits the increasing investor’s awareness that ESG factors can be tied to a company’s long-term performance.

Investor interest in ESG-related risks

There is growing interest from investors seeking to understand how organizations are identifying and responding to ESG-related risks. The largest passive investors globally including BlackRock, which has (USD$6.3 trillion in assets under management), State Street Global Advisors (USD$2.8 trillion) and the Government Pension Fund of Japan (USD$1.4 trillion), have embraced purpose and ESG considerations in their investing and risk management practices. Responsible investments have evolved from being a primarily exclusionary approach, to one focused on identifying companies that can effectively manage ESG risks and opportunities.

Managing the costs of ESG risk mitigation, as well as grasping some the opportunities around it, is something currently effectively performed by Heineken. Even though water covers 70% of our planet, only 3% is fresh water, of which 1% is accessible. A growing population, economic development and climate change are making fresh water scarce in many parts of the world. On top of that, beer is 95% water and great beer requires high quality water. Heineken took the management of this external risk into their very own Every Drop Strategy and currently they not only reduce water consumption in their breweries, they also invest time and money in activities like reforestation, landscape restoration, desalination and water capture and we work closely with other water users to protect vital watersheds.

Identification, assessing and acting upon risks

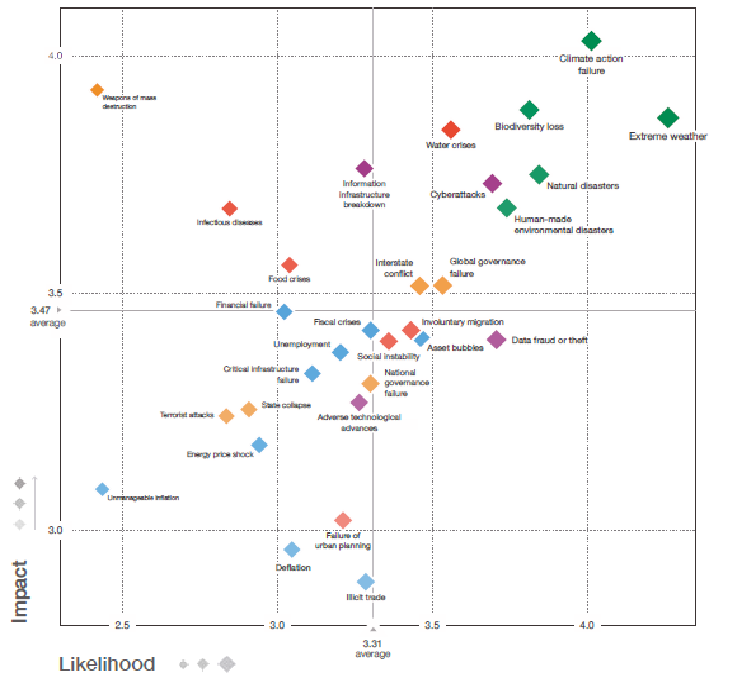

Many companies have risk management structures and processes in place to identify, assess, manage, monitor and report on risks. Usually this is summarized in annual reports to inform a broader group of shareholders involved. Each year, the World Economic Forum’s Global Risks Report surveys businesses, governments, civil society and thought leaders to understand the highest rated risks in terms of impact and likelihood. Over the last decade, the global risks have shifted significantly and are dominated by environmental risks as described in the World Economic forum 2020 risk report.

An effective risk assessment examines the extent to which the identified risks impact the entity’s strategy and business objectives. And for each individual risk the likelihood of occurrence is assessed. No surprise we believe that ESG matters should be included in enterprise risk assessments and disclosures (see article 1 of this series). All risk assessment tools have different strengths and weaknesses. Conventionally, the criteria of impact and likelihood have been used to assess all risks, regardless of the risk type and results in a heatmap. See an example of the World Economic Forum 2020 heatmap below:

These assessments and outcomes in the form of heatmaps show insights, but overall provides three main disadvantages:

- Likelihood is often defined short-term (3 to 5 years) limiting the firms’ strategic decisions in terms of long-term value creation and related investment decisions.

- It usually does not allow criteria other than “likelihood” and “impact” such as velocity or resilience to be included in the risk assessment discussion.

- In general, ESG risks are new to risk managers and often have an external component. Therefore, we see that ESG risks are not included in the heatmap or given a low rating.

We believe that risk mitigation should be quantified, monetized and analyzed with a minimum of a 10-year scope, in order to really understand the value of a risk and the options to transform a risk into an opportunity. An impact valuation in the full risk management chain might even add significant value on top of this. In the example of Heineken the risk heatmap shows a dependency of an externality like the availability of water. Consequently, there is a board decision born to move from mitigation to long term opportunity. Hence profit or loss calculations are no longer calculated from only the economical perspective, but also from the social and environmental perspective in order to capture the full impact, more on this in article 6 of this series.

About the authors:

Martin de Jong is founder of Empact, impact consultancy and working for (international) clients on Societal Strategy, ESG and Impact Valuation. He is former director Societal Value VodafoneZiggo and Sustainable Business Manager Vodafone PLC. He is guest lecturer on various universities on sustainable business.

Anne Rademaker is founder of Rademaker Consulting and working with strategic partners (both public and private) to accelerate the transition to a global circular economy. Anne is working with Martin for Empacts ESG & Impact clients. She is a former Senior Consultant at EY with extensive knowledge on Finance, Risk and Process management.

More info on Empact.