European asset managers and financial market advisors have a daunting task ahead of them in the coming four months. New legislation stemming from the EU Action Plan for a greener economy requires asset managers to classify all their investment products on the basis of sustainability by March 2021. This article examines the EU Sustainable Finance Disclosure Regulation and the EU Taxonomy Regulation and the impact they will have throughout the investment chain – from financial institutions, banks and asset managers to pension funds, retail investors and the companies they invest in. We pay special attention to what it means for NN IP and for our clients.

A greener future is a top priority for the European Union, now that the 2030 target date for achieving the environmental goals set out in the Paris Agreement and the UN’s Sustainable Development Goals (SDGs) is less than a decade away. The public sector cannot bear the entire burden of the huge investment required to meet these objectives. Companies and financial institutions need to pull together with governments, and to make sure they do, the EU is enacting an extensive framework of legislation and regulations.

For NN IP, a key piece of legislation is the Sustainable Finance Disclosure Regulation. The SFDR seeks to increase transparency on how financial market participants like asset managers and financial advisers integrate sustainability risks and opportunities into their investment decisions and recommendations. It will require them to classify all their investment funds into three categories of sustainability level – grey, light green and dark green – and to adjust their documentation, marketing material and reporting to reflect this. This standardised product labelling will give investors a better insight into how sustainable their investments are.

An action plan to finance sustainable growth

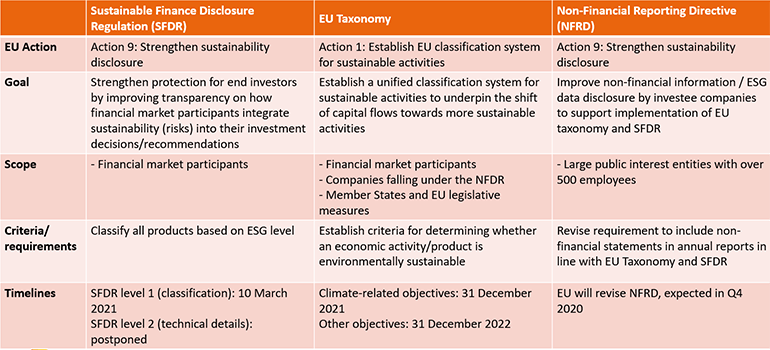

The SFDR takes effect in March and is one of the offshoots of the EU Action Plan for financing sustainable growth and a greener Europe. The 10-point plan aims to redirect capital flows towards sustainable investments, incorporate sustainability into risk management, and foster transparency and long-term vision in financial and economic activity[1]. Part of the EU Action Plan is to establish a single language when it comes to sustainability, so that all participants use the same criteria to define, measure and report on the sustainability attributes of economic activities. Implementation of the EU Action Plan will also require amendments to existing legislation, including MiFID II, BMR and the AIFMD and UCITS directives.[2]

The SFDR is closely linked to two other pieces of legislation, all part of the EU Action Plan. The first is the EU Taxonomy Regulation, which establishes the criteria for determining whether specific economic activities contribute to environmental objectives. Asset managers and other professional investors will need to disclose the proportion of investments financing taxonomy-eligible activities for each relevant financial product, including investment funds. The taxonomy currently focuses mainly on environmental issues. In the future, it will also include social and governance factors.

The second piece of legislation, the Non-Financial Reporting Directive (NFRD), includes more stringent and standardised requirements for how companies report non-financial information and how they disclose environmental, social and governance (ESG) data. Companies have been required to include non-financial statements in their annual reports since 2018. The EU will revise the NFRD to support implementation of the EU Taxonomy and the SFDR.

A chain of regulation to improve transparency and strengthen protection for end-investors

EU Action Plan: Financing Sustainable Growth

What does the SFDR mean for the financial industry and NN IP?

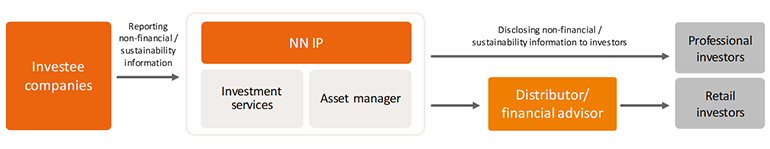

Market participants like asset managers and financial advisors will play a central role in implementing the EU Action Plan. They analyse what the companies report under the NFRD and incorporate this analysis in their investment documentation, disclosure and SFDR reporting. The products they offer are “in scope” for the SFDR and need to be classified into one of the three categories. This means that asset managers can no longer just say they have sustainable funds. They must prove it and be able to demonstrate that their investment decision-making process, risk management and product disclosure are all fully aligned.

The three classifications for investments are:

- Article 9, or dark green, which applies to products that have sustainable objectives;

- Article 8, or light green, which covers financial products that promote environmental or social characteristics as part of the broad investment strategy;

- Article 6, or grey, which applies to products that either consider ESG risks as part of the investment process or are explicitly declared as non-sustainable.

The impact of this process on any asset manager is significant. For NN IP, it requires a complete analysis of our funds and mandates so we can classify them. One advantage is that this type of analysis is not new to us. We have our own categorisation for responsible investments – ESG integrated, sustainable and impact – and publish audited figures on the assets under management that are in scope. We have been linking investments to ESG characteristics for many years. We don’t have to start from scratch and can use our own product specification criteria as a starting point, which can help us to align more easily with the new legal requirements. We also have experience with the work involved in meeting the extensive SFDR disclosure requirements. That said, we still have to prepare a full range of documentation – updated prospectuses, client agreements, fund labels and a reporting framework – to reflect the new classifications.

Information-sharing and transparency

Our experience enables us to advise clients who are facing the same issues. Some clients are also in scope for the SFDR; others still need to see whether they will be required to provide information. Pension funds, for example, will receive information and may also be required to provide it. In turn, their requests and suggestions can help us to fine-tune our methodology. Fortunately, there is plenty of discussion and information-sharing among the parties involved. We talk to our clients about our process and approach, which in turn helps them to consider how they should tackle their own preparations for these developments.

We will try to be as transparent as possible about how we are implementing these changes. We are now updating all prospectuses to get them approved before the 10 March 2021 deadline. We can communicate our final product classifications with clients only after the prospectuses are approved. We are aware that some of our clients – fund distributors, for example – are also in scope for the SFDR and face the same disclosure requirements as we do. Therefore, pending approval, we will openly discuss our direction and ambition for our product classifications with these clients in the coming months. We expect to start sharing this information in the first quarter, given the March deadline for the SFDR.

The changing face of responsible investing

In addition to the legislative and documentation requirements, implementation of the SFDR is changing how we discuss ESG with our clients. ESG is already an important part of our communication with clients, which will deepen and become even more transparent under the new rules.

These developments are likely to change the investment landscape and cause capital to move to different places. The increased transparency with regard to the sustainability of investment products will also encourage asset owners to think more about the importance of sustainability in their investments. If these asset owners also have to report to their end-clients – pension fund participants, for instance – they too will need to include ESG and sustainability in their investment decisions and reporting.

We strongly support the EU Action Plan and resulting legislation. The concept of reallocating investment to sustainable business activities matches our belief in putting capital to work. The guidelines and regulations will further improve the way we already do things and act upon.

The concept of sustainability is constantly evolving and so too will the EU Taxonomy and the SFDR. For example, the current strong environmental focus may shift to include more social elements, such as inclusion, diversity and health. As the different layers of legislation come into force over the next two to four years, market practice will also develop. This is far more than just a simple case of maintenance and compliance. It is a major step on the path to a strong, future-oriented and greener Europe and potentially a blueprint for the rest of the world.

Adrie Heinsbroek (Principal Responsible Investment Specialist) and Judith Boom (Senior Counsel Regulatory Affairs), NN Investment Partners (NN IP)

[1] European Commission – Action Plan: Financing Sustainable Growth https://ec.europa.eu/transparency/regdoc/rep/1/2018/EN/COM-2018-97-F1-EN-MAIN-PART-1.PDF [2] Markets in Financial Instruments Directive II, Benchmark Regulation, Alternative Investment Fund Managers Directive, Undertakings for Collective Investment Directive