Bron

Huffington Post

Closing the gap between existing and necessary climate finance: innovative climate finance for developing countries by a cooperation of MDBs, central banks and the private sector.

To meet the 1.5°C limit agreed in December 2015 in Paris it is necessary to rapidly replace all fossil fuels by renewable energies. In this context, the global new renewable energy (RE) investment figures presented recently by Bloomberg are very disappointing. After a decline of $40bn to $240bn in 2016, both first quarter totals of 2017 are $20bn lower than the first two quarters of 2016. This decrease in new RE-investments is not only in sharp contrast to the goals of the Paris Agreement, but also conflicts with growing interest of private finance in such investments.

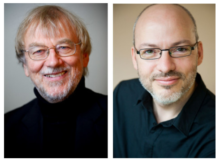

Read the full article by Jakob von Uexkull (founder of the Right Livelihood Award (’Alternative Nobel Prize’) and the World Future Council) and Dr. Matthias Kroll (Chief Economist, Future Finance, at the World Future Council)