Bron

ING

ING has worked hard over the years to build a power generation lending book that’s 60% renewables, outperforming by far the most ambitious climate goal of the Paris Agreement. ING announced to go a step further aim to grow new financing of renewable energy by 50% by year-end 2025 and will no longer provide dedicated finance to new oil & gas fields.

These steps are aligned with the ‘Net-Zero Emissions by 2050 Roadmap’ by the International Energy Agency. Massive investment is needed in clean energy and infrastructure, which will then lead to a decrease in demand for fossil fuels, according to the roadmap. That reduced demand should be met by existing oil and gas fields, which means that in both the IEA’s and our view, no new fields should be needed.

These steps also support the European Union’s ‘Fit for 55’ and ‘REPowerEU’ plans. Also there, key elements are oil and gas supplies from existing fields, investments in clean energy and infrastructure for the electrified economy, and energy efficiency.

“The best way to reduce dependency on fossil fuels is to make sure there are enough affordable green alternatives available,” said Michiel de Haan, head of ING’s energy sector. “These steps support that and show we’re serious about putting our financing to work to facilitate the energy transition.”

In developing ING’s energy strategy, we balance three key interests: the need to decarbonise to fight climate change, the need for energy to remain affordable for people and companies, and the need for security of the energy supply.

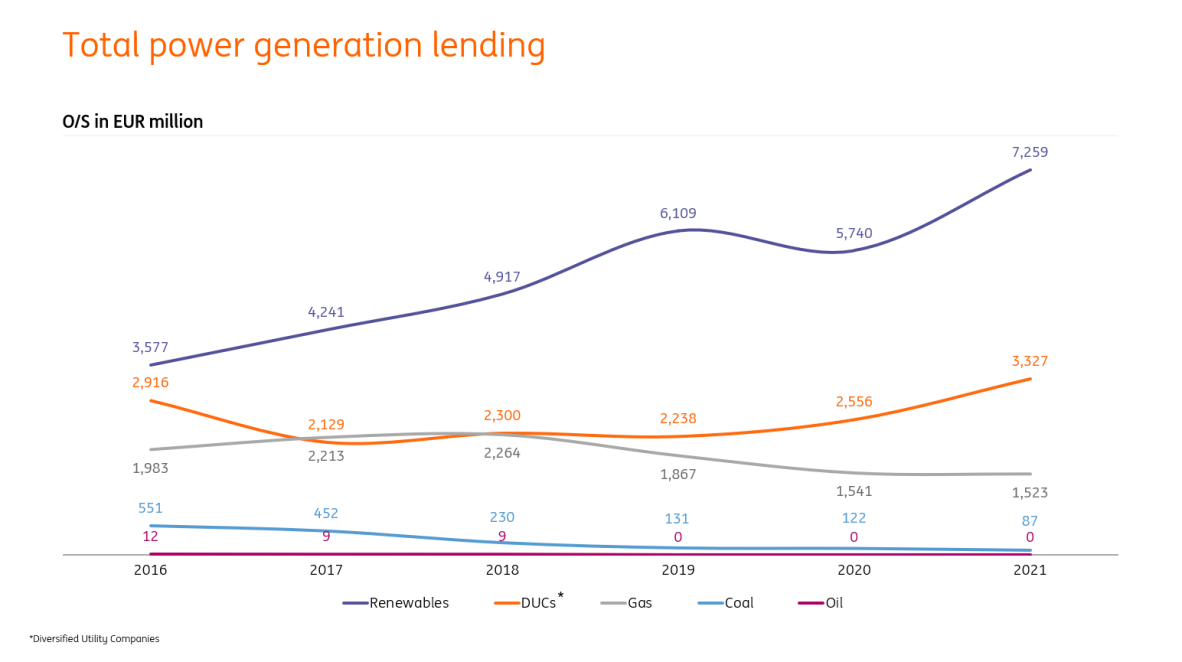

The steps we announced today follow a path we embarked on years ago. Looking at our power generation portfolio, we pledged in 2017 to exit coal-fired power plants by 2025 and have since then decreased our exposure by 80%. At the same time, we more than doubled our financing of power generation from renewable energy sources such as solar and wind, which now makes up almost 60% of our power generation portfolio.

“The restriction announced refers to dedicated upstream finance (lending or capital markets) for oil & gas fields approved for development after 31 December 2021. At the same time, we will continue to provide financing to clients active in keeping oil and gas flowing, in line with efforts to keep energy secure and affordable during the low-carbon transition.”

The new announcement is part of ING’s Terra approach to steer our portfolio towards keeping the rise in global temperatures to 1.5 degrees Celsius to achieve net zero by 2050. For further details please see our integrated climate report.