Amsterdam and London have topped the latest global rankings of green financial centres, according to the latest edition of the Global Green Finance Index. Copenhagen and Paris came second. But overall scores reflect that the share of financial markets that can be considered sustainable remains very low.

The Global Green Finance Index (GGFI) is published every six months and ranks global financial centres according to the depth and quality of their green finance offerings. In today’s report, GGFI 2:

- Amsterdam and Copenhagen came first and second for depth, pushing London into third place.

- In the quality rankings, Paris moved up three places to second, with London retaining its top spot.

- In North America, Montreal came first for depth and San Francisco first for quality.

- Shanghai, Casablanca, São Paulo and Prague topped the rankings for both depth and quality in their regions.

- The biggest improvers were San Francisco, Toronto, and Vienna, which moved up five or more places in the depth index. Munich, Copenhagen, Toronto, and Madrid moved up five or more places for quality.

- Paris, Frankfurt, and Singapore led the centres most cited as likely to become more significant over the next two to three years.

- Renewable energy investment, sustainable infrastructure finance, and green bonds remained the areas of most interest.

- There was increasing interest in fossil fuel disinvestment, carbon disclosure and green insurance.

- The data suggest that leadership on quality of life issues may be an enabling factor for the growth of green finance.

Dr. Simon Zadek, Visiting Professor at Singapore Management University, and Principal of Project Catalyst at the United Nations Development Programme said:

“Financial centres have a central role in aligning financial flows with the Sustainable Development Goals, including climate outcomes. The Global Green Finance Index helps us track progress, and should inform our collective efforts to secure this alignment.”

Dr Kirsten Dunlop, Chief Executive Officer of EIT Climate-KIC, said:

“This Index comes at a time when the full cost of a rapidly changing climate system is moving from scientific consensus to observable reality. In order to secure a prosperous zero-carbon future, we need to go further & faster in our efforts to rewire the global financial system. The Index brings useful visibility over our collective progress and will help to mobilise more financial centres to approach sustainable investment with renewed effort and intent.”

Professor Michael Mainelli, Executive Chairman of Z/Yen Group, said:

“The leading centres in the index were generally rated higher for the quality of their green finance than they were for depth. This indicates both the scale of transition facing larger centres and the potential for smaller financial centres to advance through specialisation, a trend that is already playing out in the rankings.”

Benoît Lallemand, Secretary General of Finance Watch, said:

“The survey shows increasing levels of interest in fossil fuel disinvestment and carbon disclosure. This is a welcome trend that we hope policymakers and investors will encourage. Overall, we see a mismatch between some of the hype around green finance and the reality of financial flows. We’ll campaign with our partners to reconcile the two.”

André Hoffmann, President of MAVA Fondation pour la Nature, said:

“Financial centres are uniquely well placed to drive the changes in incentives and understanding needed to achieve sustainable economic transition. Today’s report underlines the strong support among market participants for policymakers to intervene, both to catalyse growth in this sector and to shape the financial system to support sustainability goals.”

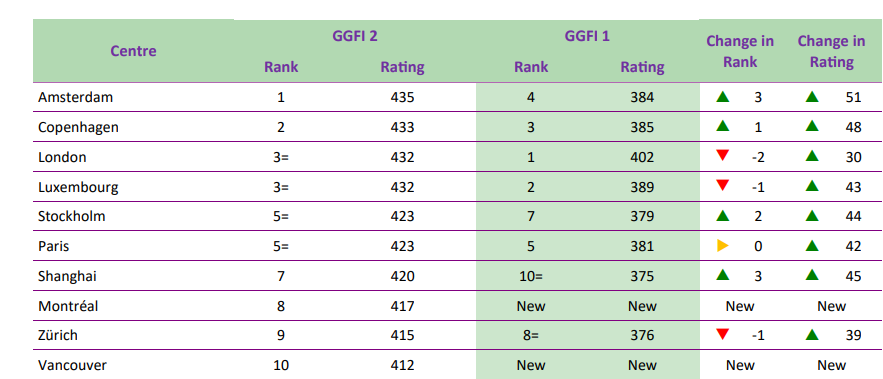

GGFI 2 results:

Top 10 centres for depth:

Top 10 centres for quality:

- London

- Paris

- Amsterdam

- Copenhagen

- Stockholm

- Luxembourg

- Zurich

- Hamburg

- Munich

- San Francisco

Download the full report: Global Green Finance Index 2 (pdf)