In an effort to help inform company and investor decision making around ESG ratings, SustainAbility embarked on a two phase research process to provide updated data on perceptions of ESG ratings today.

In this first phase, SustainAbility analyzed the results of a global survey conducted with their partner organization GlobeScan. SustainAbility polled several thousand sustainability professionals to assess their views on what makes a good sustainability rating and which ratings they see as being of the highest value and usefulness. The team also assessed how they are using ESG ratings and what changes they would like to see in order for ratings to better serve companies, investors and other stakeholders.

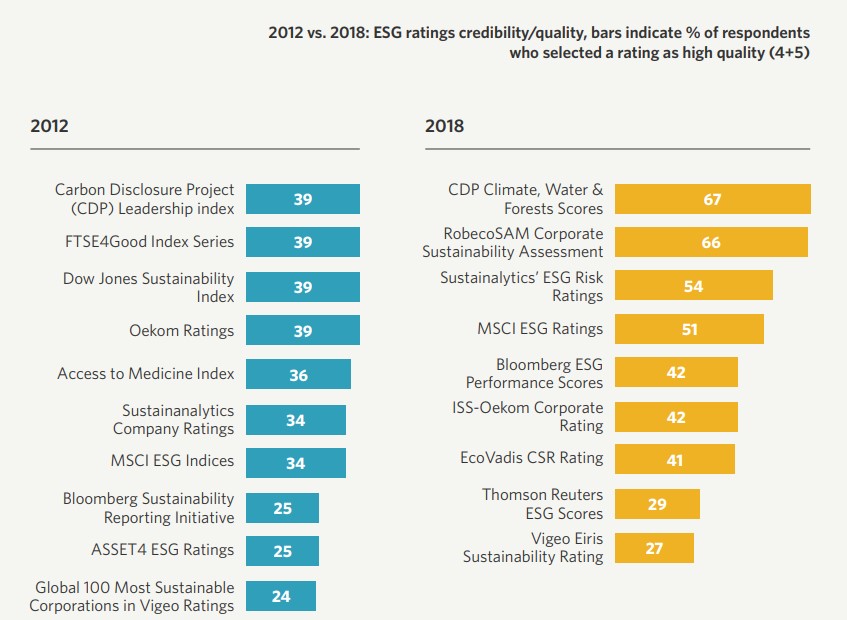

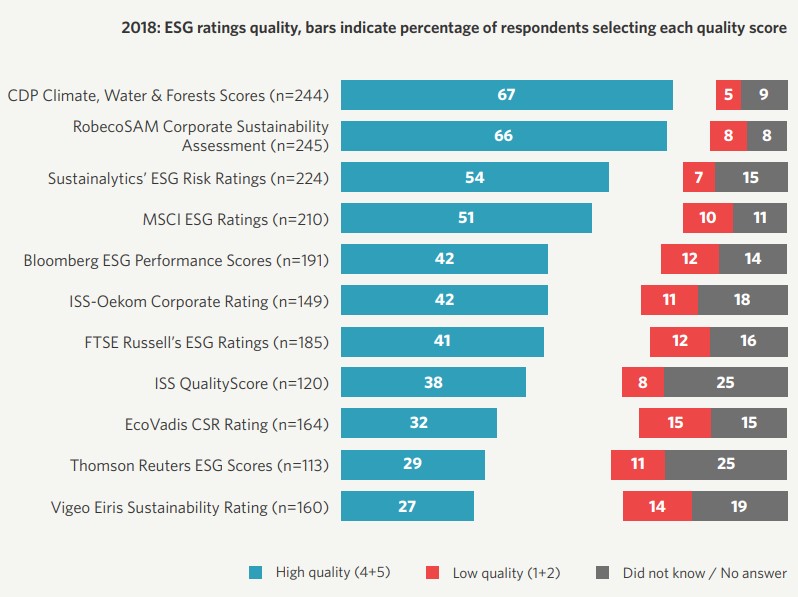

The new report outlines the results from the hundreds of survey responses received, most of them from corporate practitioners in Europe and North America with more than five years of experience in sustainability. Throughout the report, the team draw comparisons between the 2018 survey and the original 2012 survey. While our original Rate the Raters research considered ratings, rankings and indices, they decided to focus on ratings alone for the 2018 survey and selected eleven of the most widely used ESG ratings for assessment. Also the survey questions changed slightly. The 2012 survey asked respondents to evaluate the “credibility” of ratings, while the 2018 survey focuses on “quality” and “usefulness” of ratings. In 2012, more than 850 experts responded to the survey, whereas in 2018 they received 318 responses. This reduced response rate may align with the general survey fatigue that have been seen with other survey research in the last several years.

The second Rate the Raters report, to be released later this year, will be based on the results of an investor survey and qualitative interviews designed to gauge investor views on ESG ratings.

The researchers look forward to comparing and reflecting upon the results from both phases of this 2019 research and using the outcomes to help inform conclusions and recommendations for raters, companies, investors and other stakeholders working with and within the ESG ratings landscape.