Bron

Climate Bonds

Climate Bonds launched its Green Bonds: the State of the Market 2018 report on the first day of our Annual Conference in London. Produced with the support of HSBC and Amundi, this is the first publication in a new annual series of reports, focusing primarily on labelled green bonds and the latest developments on a global scale.

2018 highlights:

Global green bond market:

- 2018 issuance: USD167.6bn (2017: USD162.1bn) 2018 labelled bond market size

- Market share: USA 20%, China 18%, France 8%, Germany 5%, Netherlands 4%

- Top 3 issuers Fannie Mae USA (USD 20.1bn), Industrial Bank China, (USD9.6bn), Republic of France (USD6bn)

- Cumulative green bond issuance since 2007: USD521bn

- USA leading with USD118.6bn, followed by China (USD77.5bn) and France (USD56.7bn)

Wider labelled universe:

- USD167.6bn green bonds, which meet the CBI green bond database screening criteria

- USD21.0bn sustainability / SDG / ESG bonds and loans financing green and social projects

- USD14.2bn social bonds financing social projects

- USD23.7bn green bonds, which do not meet the CBI green bond database screening criteria

Outlook for 2019 and beyond:

- Green bond growth expected from financial institutions, sovereigns, Certified Climate Bonds and climate-aligned issuers

- Continued harmonisation of taxonomies and use of green bond guidelines

- Growth of other labelled issuance (sustainability/SDG bonds and social bonds)

Post-issuance reporting in the green bond market

In 2018, CBI undertook research into post-issuance reporting practices for the second time. The findings are summarised and analysed in our study Post-issuance reporting in the green bond market, published in March 2019, and compared to the previous findings set out in our inaugural report from June 2017.

The purpose of this research is twofold. It pivots on assessing whether issuers are reporting, but it also provides an update on the allocation of proceeds that are recorded on CBI green bond database.

The research’s findings show that two-thirds of issuance by amount had both use-of-proceeds and impact reporting. Notably, we also found that a third of issuance by amount, for which there was no specific upfront commitment, did, in fact, report. This suggests issuers understand the need for transparency and disclosure, however harmonisation of templates and metrics is needed to facilitate the analysis and comparison of reports.

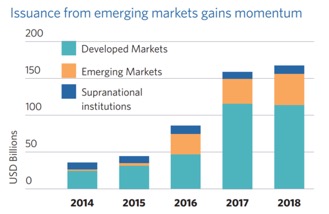

Emerging markets in 2018: A big leap forward in Asia-Pacific

The first emerging markets’ (EM) green bonds were issued in South Africa in 2012. EM green bond issuance now accounts for about a quarter of total issuance to-date.

China’s entry in 2016 and push in 2017 boosted overall EM issuance. China has the second largest green bond market globally and accounts for over 70% of the total EM issuance to-date, and about the same in 2018.

Issuance from other EM countries remains fairly small compared to global volume. However, the number of new issuers entering the market has increased over the past five years. It reached 85 debut issuers in 2018 or 42% of the global total, which is a significant achievement given the relatively small size of most EM bond markets.

Hot spots for 2019-2020 Asian EM issuance: Indonesia, Malaysia, Philippines, Thailand & Vietnam

Rest of the world

In Europe, we have already seen 2019 issuance from Poland and Iceland, and expect further involvement from Central and Eastern Europe.

We hope to see a rebound in issuance and growth beyond in India and Latin America. There is momentum for sovereign issuance from Africa coming from Kenya, Egypt and Nigeria.

And we expect continued strong engagement from China.

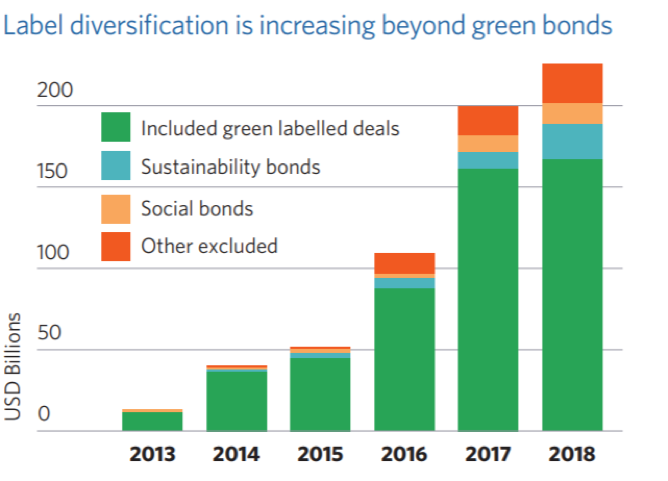

The wider labelled universe: sustainability bonds, social bonds, SDG bonds, blue bonds …

The labelled bond market has expanded beyond green bonds. Sustainability and social bonds have been around for a few years now, but their prominence was noted in 2018, with SDG bonds also emerging as issuers and investors starting to adopt policies and strategies linked to the UN’s 17 Sustainable Development Goals.

Climate Bonds supports the Sustainable Development Goals (SDGs) overall and see many links between green bond finance and specific SDGs, in particular, SDGs 6,7,9,11,13, 14 and 15.

Notwithstanding this, CBI remains focused on green bonds, which are specifically linked to climate change-change mitigation, adaptation and resilience. Consequently, the proportion of proceeds allocated to social projects which are not also green needs to be no more than 5% for inclusion in the CBI green bond database.

2018 has been a year of consolidation for the green bond market with good progress in the development of taxonomies and harmonisation efforts. As a result, we would hope to see greater alignment of future deals to the Climate Bonds Taxonomy which should lead to fewer exclusions in CBI’s screening process.

Climate Bonds outlook

The October 2018 release of the IPCC SR15 report has exploded any faint illusions that the world still has the comfort of decades to take decisive action on climate. Against the ticking clock that SR15 loudly amplified, pressure comes from all quarters that climate and green investment must increase.

The predictions of annual issuance for 2019 range from USD140bn to USD300bn. That continues to be the big benchmark that banks, insurers and corporates must deliver. By end 2020 the public scrutiny on those who are not investing in green and contributing to the transition to a low-carbon economy will likely be sharper.

In the interim, investors are pushing harder on the world’s largest emitters. The Climate Action 100+ initiative, one of the projects that form the ‘Investor Agenda’, has established a straight line of corporate governance engagement between a USD32tn coalition of institutional investors and the 160 largest global emitters. The Investor Agenda itself is a collective investor action project with a broad climate agenda.

Speeding the brown-to-green transition is one of the endpoints of the engagement. This must mean attention moving from risk assessments and statements of intent to the actual capex plans of big emitters, their borrowing programmes, and balance sheets.

Brown-to-green transition in practice means large companies straddling both brown and green assets, and the sooner investor pressure results in greener capex, the better.

More banks need to lead on green bonds, green loans, green mortgages and other retail and corporate banking and investment products in 2019 and beyond. Those that do not, will in time, face institutional investors and civil society, framing the green investment question as fundamental to their licence to operate.

Nation states as sovereign issuers of green bonds also have a role. Kenya, the Netherlands, and Egypt have foreshadowed 2019 green issuance. Yet gaps remain amongst G20, OECD and EMEA nations. Treasuries and Finance Ministries can deploy green bonds to finance NDCs under the Paris Agreement, but, more importantly, sovereign issuance raises the country’s green profile for investors, and has the power to mobilise private capital and spur additional issuance.

This year will see a strengthening of grass root calls for more nations to act. We are not on track to limit temperature rise under 2°C; rather, we are on set to reach 3°C or more.

The Green Bonds State of the Market 2018 report shows how far we’ve come but the trillions needed through the next decade to support low carbon growth paths in China, India, Africa, and LATAM are not in sight yet. What’s really at stake in 2019 is not so much a calendar issue, it’s whether we cruise or accelerate into the 2020s.