Bron

IMF

Unsafe working conditions. Use of child or forced labor. Environmental impact on protected areas. More and more investors are looking at issues and factors beyond traditional financial analysis when directing their money. Sustainable finance aims to help society better meet today’s needs and ensure that future generations will be able to meet theirs too. The latest IMF Global Financial Stability Report discusses the link between sustainable finance and financial stability and suggests policies for the way forward.

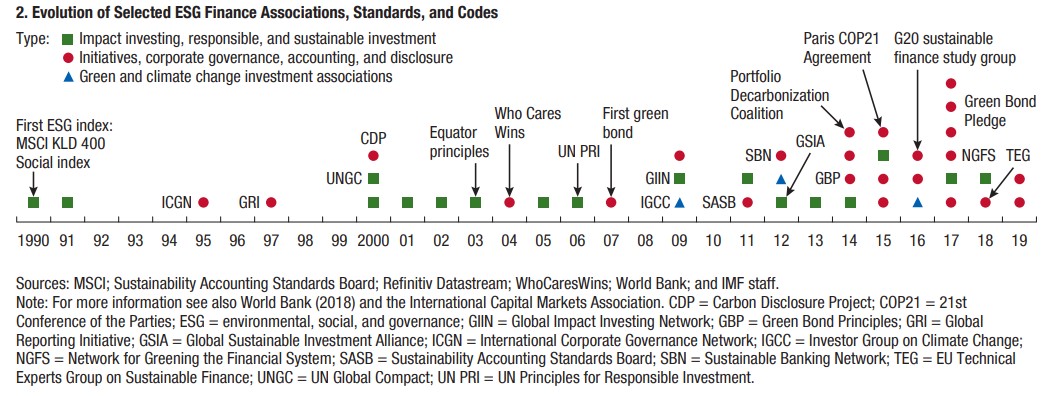

Sustainable finance incorporates environmental, social, and governance (ESG) principles into business decisions and investment strategies. It covers many issues from climate change and pollution to labor practices, consumer privacy, and corporate competitive behavior. Efforts to incorporate these kinds of considerations in finance started 30 years ago but accelerated only in recent years.

ESG and financial stability

Environmental, social, and governance issues can have a material impact on firms’ performance and on the stability of the financial system more broadly. Governance failures at banks and corporations contributed to the Asian and the global financial crises. Social risks, for example in the case of inequality, may tempt policymakers to unduly facilitate household borrowing for consumption and could lead to financial instability over the medium-term. Environmental catastrophes have caused large losses to firms and insurers.

Climate change features prominently in sustainable finance. Here, there are two main channels of risks. Physical risks include damages from weather-related events and broader climate trends. Transition risks arise from changes in the price of stranded assets (assets such as coal and oil that will not be used during the fossil fuel phase-out) and relate to the economic disruptions from climate-related policies, technology, and market sentiment during the adjustment to a lower-carbon economy.

Financial risks from climate change are difficult to quantify, but most studies point to economic and financial cost estimates in trillions of dollars. Already, insurance losses from climate-related natural disasters such as droughts, floods, and wildfires have quadrupled since the 1980s. Asset prices may not yet fully internalize climate risk and the transition to a cleaner economy. Delayed recognition of these risks could lead to a cliff-like moment when investors suddenly demand this risk be priced into asset values with potentially detrimental consequences for financial stability.

ESG in portfolio investment

Elements of ESG principles (particularly on corporate governance) have long been incorporated in portfolio investment strategies, and today, the assets under management of ESG-related funds range between $3 trillion and $31 trillion, depending on the definition. Applying principles of sustainability began in equities markets through investor activism as an attempt to influence corporate action, and later extended to fixed income markets, primarily with bonds that finance environmental projects, so-called green bonds.

Sustainable investing started with screening out firms or entire sectors viewed as being unsustainable. But concerns about risk management, underperformance, and lack of ultimate impact have created new strategies. With the expectation that companies that “do good, do well,” new strategies focus on positive attributes of firms, such as strong shareholder engagement, minimum environmental or safety standards, or commitments to invest in sustainable activities.

Sustainable finance impact

Corporations don’t report on sustainability regularly or consistently, particularly with respect to the environmental and social dimensions. This makes it difficult for investors to incorporate ESG principles to their portfolios. Third party providers of ESG scores aim to provide standardized assessments, but sometimes it’s difficult for them to arrive at an accurate picture given a lack of information.

There is also uncertainty with measuring the impact of ESG activities in achieving goals such as reducing emissions or raising labor standards. Greenwashing—false claims of ESG compliance of assets and funds—is also a concern that may give rise to reputational risks. Mixed evidence on the performance and impact of ESG funds makes it challenging for investors, especially public sector pension funds, to incorporate these principles in their investments. Firms face challenges as well: although they stand to benefit from integrating ESG factors in their business models, the positive outcomes are usually long term, but the high costs of disclosure are immediate.

Strong policies needed

For sustainable finance to effectively address critical risks, urgent and decisive policies are needed in four key respects:

- Standardization of ESG investment terminology, as well as clarifications of what activities constitute environmental, social, and governance;

- Consistent disclosure by firms to incentivize investors to use ESG data;

- Multilateral cooperation to encourage participation from more countries and avoid setting different standards; and

- Implementation of policies incentivizing investment in sustainability, and requiring public disclosure of the cost of inaction.

The IMF will continue to incorporate ESG-related considerations, in particular related to climate change, when critical to the macroeconomy through its multilateral surveillance work, such as in the Fiscal Monitor, future Global Financial Stability Reports, as well as its bilateral surveillance efforts.