Bron

Novethic

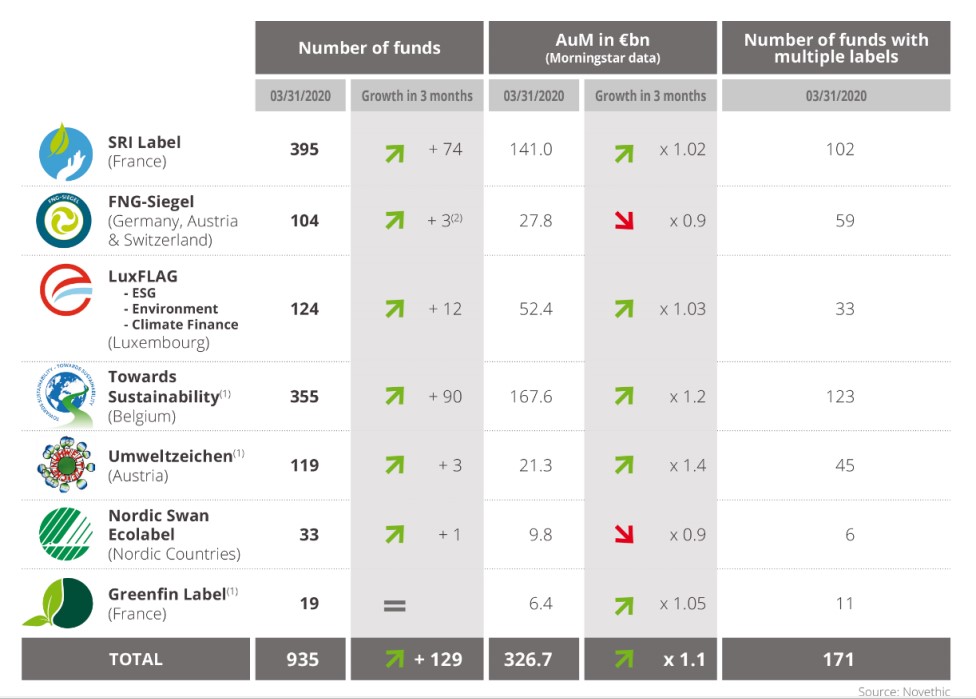

Novethic publishes a new update of its overview of the European market for sustainable finance labels with a focus on the rules applicable to bond funds. In just a few months, more than a hundred additional funds have been labelled and investors are approaching 1,000 label awards at the end of the first quarter, with assets under management exceeding €300 billion. While the momentum is strong, it does not come with a homogenisation of the standards, which complicates the task of the 170 funds that have several sustainable finance labels.

Increased competition between rapidly developing players

With 935 labelled funds and more than 326 billion euros in assets under management at the end of the first quarter, the market has taken another leap forward in 2020. The French SRI Label and the Belgian standard Towards Sustainability, the latest newcomer in the landscape of European sustainable finance labels, are still the leading duo, each with more than 300 labelled funds and more than €100 billion in assets under management. At the end of the first quarter, the SRI Label ranked first in terms of the number of funds (395 versus 355), but it was behind Towards Sustainability in terms of assets under management (141 billion versus 168 billion euros).

The other labels, in particular LuxFLAG ESG, the German-speaking labels FNG and Umweltzeichen, and the North European Nordic Swan, maintained their momentum despite relatively modest volumes of assets under management. Another strong trend is the growing number of double or triple labelling, with around fifty additional funds choosing this option during the quarter.

Sustainable finance labels are adapting to impulses from the new European framework

The European market is already under the influence of the new frameworks created for sustainable finance by the European Union: the taxonomy and reporting regulations for sustainable funds. Three label promoters listed in this overview are anticipating these new standards and have already begun to integrate the European taxonomy, a reference framework for activities with environmental benefits, into their standards.

The Austrian Umweltzeichen, for example, will require proof of compliance with the European scheme and is extending its labelling to deposit and savings accounts. The German FNG label goes even further and already uses the European taxonomy for green funds and requires a detailed “explicit sustainable strategy” in writing. For its part, the Belgian Towards Sustainability is working on a review to fine-tune and upgrade its standard by 2021.

New: Green bonds and exclusions, a culture shock

This overview presents for the first time an analysis of the labelling of bond funds. This asset class represents more than 200 funds to date, including around twenty green bond funds. From one label to another, the environmental exclusion criteria for fossil fuels vary greatly, as do their linkage with green bonds. For example, the French public label Greenfin can be awarded to a fund that invests in a green bond issued by a gas company since Greenfin sector exclusions do not apply to green bond issuances. On the other hand, the Austrian label does not allow holdings of French sovereign green bonds since the nuclear exclusion criterion also applies in this case.