Impact investment is rapidly growing. Why? What are the developments? And how does this business pushes towards the transition to a sustainable and inclusive society? In 6 articles we will highlight the developments, opportunities and risks of Purpose & Impact investment. This is the sixth and final article.

Using Environmental Social Governance (“ESG”) disclosures only to comply is a missed opportunity. Why not to position ESG more strategically? This will support the purpose and sustainable strategy of a company. Moreover it will create a better ESG rating which is relevant for investors. If ESG is positioned at the core of a company, long-term value is automatically created and the need for a better ESG performance will emerge. Impact measurement and valuation enables this by creating quantitative, comparable intelligence instead of simply ‘check in the box’ information.

ESG investing needs impact measurement

ESG disclosure is long time seen as ‘compliance’. Company’s Investor Relations Departments needed to ‘check the box’, as the financials, strategy and outlook are the prime concerns of investors. And yes this still the case but times are changing. Employees are demanding a purpose with societal impact, customers will punish brands for not doing good, regulations on all ESG topics are put in place all over the world and many more developments show that ESG must be in the core of corporates. Especially as ESG investing is now mainstream amongst institutional investors. And with that, ESG disclosure is becoming a strategic topic of the company. This is the time to move forward and use ESG disclosure as an opportunity instead as compliance or even a risk (see article 2 of this series). In this article we explore the next phase of ESG investing and how impact measurement and valuation fit in the ESG assessment.

ESG: Moving from a ‘check the box’ activity towards a core company competence

In August 2020, the CFA institute published a draft standard for the disclosure of the ESG performance of investment products, as they recognized the need for this. It’s just one of the many developments in the last 2-3 years which indicates that financial markets see the value of ESG disclosures. There are a number of issues on ESG disclosures, the main one might be the focus on intention rather than output or outcome. Companies publish their ESG policies, hence they check the box. And most companies quantify and publish their sustainability results, sometimes even connect them with strategic and operational targets. That’s output reporting, but mostly it just covers only one part of ESG scope. There is an emerging need for outcome reporting and moreover, impact measurement as Harvard professor George Serafeim put it.

The Harvard Business Review have published in its September/October 2020 edition an article by prof George Serafeim on ESG integration. Based on academic research his Harvard team discovered there is a need for ESG integration within companies in order to seize the ESG opportunities. They have identified 5 recommendations around ESG:

- Adopt strategic ESG practices;

- Create accountability structures for ESG;

- Connect company purpose with ESG;

- Decentralize to execute ESG strategy;

- Be transparent and report about ESG performance.

The need for impact measurement

ESG focuses on minimizing the harm a company has on society and be transparent about this. ESG is also investor focussed, a way for a company to share in a ‘standarized’ manner their environmental and social efforts. Within companies ESG is often part of the Sustainability Department sharing ownership with the compliance team. The plea of professor George Serafeim is to really incorporate ESG within organisations. Hence, strategic ESG is not only minimizing that environmental harm, but about building a purpose and strategy to optimize the positive effect a business has on society.

This call for strategic ESG seems part of a larger discussion on corporate transformation towards more sustainable efforts, CSR, shared value and purpose based business. But the difference is the financial angle. For investors ESG and the ESG rating is the only ‘objective’ way to ensure their investments are meeting today’s standards on how business is or should be operating. As previous articles of this series have shown, there is a limitation to this way of ESG assessment as it’s merely qualitative information. ESG should be quantified in order to really manage and benchmark the performance of a company. Impact measurement and valuation of ESG data will help to drive the quantification.

What’s impact measurement and valuation?

The measurement of societal impact of a company and the valuation of that measurement to bring impact into perspective, can help to grasp the intangible, help to understand the Economical, Natural, Social and Human value that a company is creating and detracting from society. It helps to flag risks in the value chain and offers a way to build a purpose-based strategy. In short, Impact Valuation: measures the positive and negative impact a business has on society in order to optimize the connection with the society.

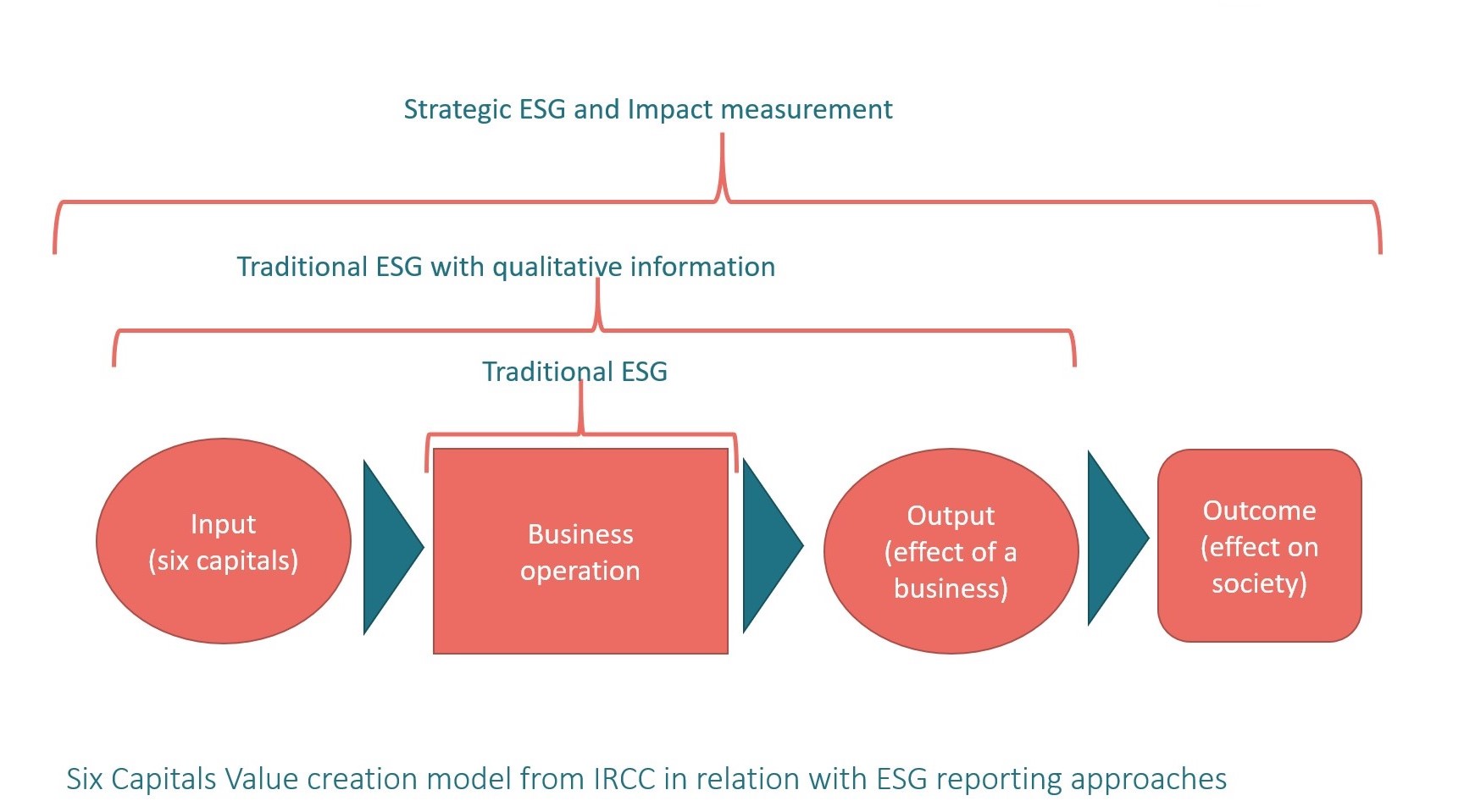

In corporate reporting a very often used model to clarify the Environmental and Social effects of a company and its impact, is the IRCC six capital model. Traditional ESG reporting focusses on the business operations. Over the years the scope of ESG reporting expanded to more (up to six) capitals and wider by including Input and Output of company. In practice the most relevant impact of a company is not quantified, but just qualitatively reported. And with ESG starting to be mainstream for companies and investors, that is a missed opportunity. Strategic ESG needs impact measurement and valuation in order to share with investors the real societal effects of the activities of a company.

Issues of quantifying ESG performance

We believe that impact measurement and valuation of that measurement, is important to move ESG from compliance to strategy. This drive the alignment between company agenda’s and global agenda’s (more in Article 3). Moreover this is important for investors to really access the value of a company. By using big data, an ESG rating agency can determine which industries have positive environmental and social effects. But within an industry it becomes difficult, especially with a large number of possible investments. In the classic ESG approach, being compliant was sufficient. But as we in the previous articles of this series have shown, ESG has become a differentiator and even strategic decision tool for an investor.

However impact measurement and valuation aren’t always the answer. The difficulty lies in the calculation and benchmarking of the impact itself (interesting discussions on the Harvard Idea Lab). As impact measurement is new to the world, so are the available techniques and the appliance of those techniques (and standards). It seems that the E (environment) is the easiest one. Carbon emissions, even in scope 3, are pretty solid. One can calculate with it and start valuing. Comparing the impact and avoided environmental effects is already food for discussion. Comparing the e-impact of one company with another, builds on this discussion. KPI’s like carbon efficiency per asset or product are used, but if a part of the operations of a company is outsourced, while a comparing company is executing those operations themselves, the comparison is already hard to do. Once adding social elements in the impact measurement, direct and indirect (for example the environmental, social and economic impact of home working as part of the product offerings of Vodafone), impact measurement and valuation can’t be used within ESG assessment by investors. It’s just not objective enough.

If a company is publishing as part of their ESG performance, impact measurement and valuation it will give two insights:

- That company gets it;

- The measurement will be applicable for future benchmark of that company.

ESG is moving towards a more strategic approach. Not only a better business performance is the driver for this, but also large investors (like Blackrock) are expecting this. In order to understand the ESG performance of a company, those large investors are looking for new ways access this. Next to more and better ESG data, we also see the knowledge of investors is rapidly increasing. Former CSO’s and sustainability directors are hired by investors and hence the (internal) knowledge is growing. This calls for a more solid manner to be transparent about the ESG performance. Impact measurement and valuation is the answer to this call and leads to ESG investing with impact measurement.

About the authors

Martin de Jong is founder of Empact, impact consultancy and working for (international) clients on Societal Strategy, ESG and Impact Valuation. He is former director Societal Value VodafoneZiggo and Sustainable Business Manager Vodafone PLC. He is guest lecturer on various universities on sustainable business.

Anne Rademaker is founder of Rademaker Consulting and working with strategic partners (both public and private) to accelerate the transition to a global circular economy. Anne is working with Martin for Empacts ESG & Impact clients. She is a former Senior Consultant at EY with extensive knowledge on Finance, Risk and Process management.

More info on Empact.