Bron

World Bank

The phone call to the World Bank Treasury came out of the blue: in late 2007, a group of Swedish pension funds wanted to invest in projects that help the climate, but they did not know how to find these projects. But they knew where to turn and called on the World Bank to help. Less than a year later, the World Bank issued the first green bond—and with it, created a new way to connect financing from investors to climate projects.

Bonds are essentially an agreement where issuers borrow funds from investors and must repay investors at an agreed rate after a specified amount of time. Governments, companies and many others issue bonds to borrow money for projects. Issuing a bond was nothing new for the World Bank—it has been issuing bonds since 1947 to raise financing from the capital markets for its development projects. But the concept of a bond that is dedicated to a specific kind of project had not been tested before. The green bond turned out to be a history-making event that fundamentally changed the way investors, development experts, policymakers, and scientists work together.

A stark warning

In 2007, the Intergovernmental Panel for Climate Change—a United Nations agency that provides scientific data on climate change and its political and economic impacts—published a report that undeniably linked human action to global warming. The finding, along with increasing occurrences of natural disasters, prompted a group of Swedish pension funds to think about how they could use the savings they were stewarding toward a solution. They called on their bank, SEB (Sandinaviska Enskilda Banken AB) to see what could be done. And SEB connected the dots between the financing that was seeking to reduce risks for the investors and make a positive impact, and the World Bank with its deep knowledge on investing in environment projects around the world.

Thinking outside the box

In hindsight, the solution seems straightforward. Investors wanted a safe place to put their money and know that they were making a difference. The World Bank had environment projects to finance, a track record as a high-quality bond issuer, and the ability to report on the impact of its projects. But there was a missing link: how could investors be truly certain that the projects they were supporting addressed climate concerns?

This triggered another phone call, this time to CICERO, the Centre for International Climate and Environmental Research— an interdisciplinary research center for climate research in Oslo. CICERO scientists were leading experts on climate issues. They could provide a credible view on whether a project was going to make a positive impact on the environment.

What followed were many more conversations among the pension funds, SEB, CICERO, and the World Bank Treasury. The conversations were often difficult—especially since more often than not, the different organizations spoke different languages, and it was challenging to bridge the gap between finance, development and science.

A joint commitment to finding a solution

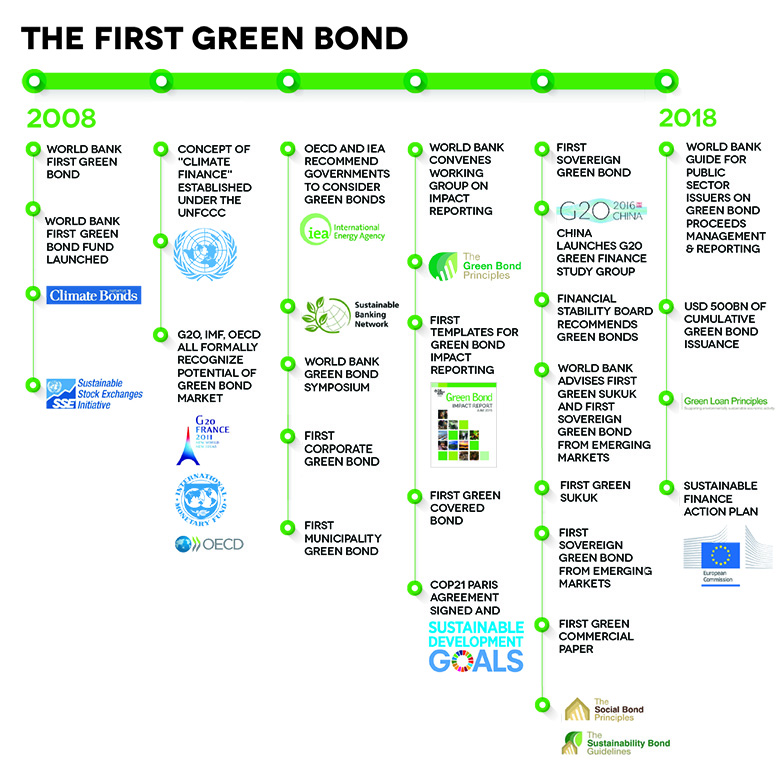

Success ultimately came in November 2008, when the World Bank issued the green bond. The bond created the blueprint for today’s green bond market. It defined the criteria for projects eligible for green bond support, included CICERO as a second opinion provider, and added impact reporting as an integral part of the process. It also piloted a new model of collaboration among investors, banks, development agencies and scientists. Ultimately, it was the result of their commitment, perseverance, and drive to find a solution.

The World Bank green bond raised awareness for the challenges of climate change and demonstrated the potential for investors to support climate solutions through safe investments without giving up financial returns. It formed the basis for the Green Bond Principles coordinated by ICMA, the International Capital Markets Association. It highlighted the social value that bonds could create and the need for a sharper focus on transparency.