Green bond issuance has surpassed the USD100bn mark for 2019. Climate Bonds expects that the impact of the EU TEG process will help open the 2020s path towards the vital first trillion in annual green finance investment.

The USD100bn benchmark was first met in November 2017 during COP23 and then in mid-September in 2018. Several bonds that settled late last week and three deals which settled on 24th June (Alliander – EUR300m [USD342m] Vattenfall – EUR500m [USD569m] and Korea Electric Power Corp – USD1bn) have taken Climate Bonds market data figures on cumulative labelled green issuance for 2019 to USD106.7bn, above the USD100bn mark.

Forecasts for final annual issuance in 2019 range from USD180bn through to USD240 bn to USD250bn.

Green Bond Issuance USD 100 billion Milestones 2017-19

| Year | $100bn Mark in Issuance | Annual Green Issuance: (Initial Figure) – Adjusted Current Figure |

| 2017 | November | (USD 154.886) USD162.7bn |

| 2018 | September | (USD 163.665) USD169.6bn |

| 2019 | June | Forecast: USD 180-250bn |

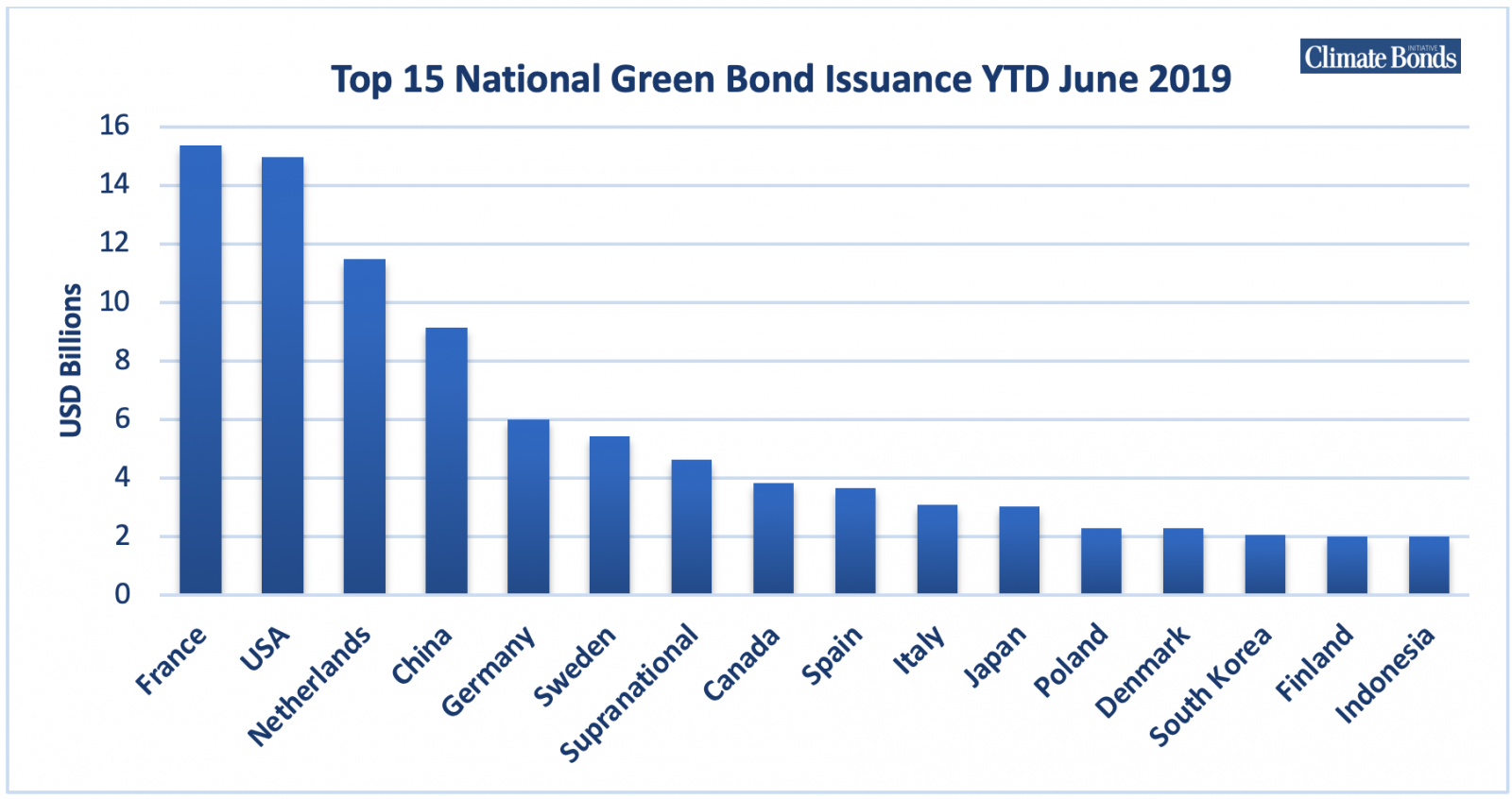

Big Issuers to date in 2019d

The largest corporate bonds issued to date in 2019 have been from Engie at EUR1.7bn, LG Chem at USD1.6bn, the Industrial and Commercial Bank of China (ICBC) and MidAmerican Energy, both at USD 1.5bn. The largest Sovereign green bond in 2019 to date has been a Climate Bonds Certified issuance from the Netherlands at USD6.7bn.

Top 15 National Green Bond Issuance YTD June 2019