If we are to achieve the climate targets set by the Paris Accord, it will be necessary to change the way we travel. Transport is the second-largest contributor to global greenhouse gas (GHG) emissions. It is responsible for 23% of all energy-related CO2 emissions and 14% of total GHG emissions. In the EU, changing regulations make it imperative for car manufacturers to evolve towards low-carbon forms of transport. NN Investment Partners has identified green bond issuance as a powerful but underutilized tool that could help to finance the transport revolution.

Within the transport sector, road transportation remains a major contributor to CO2 emissions. In 2016, it contributed nearly 21% of the European Union’s total CO2 emissions, with cars alone producing around 12% of total EU emissions. In order to trim down CO2 emissions from cars, the EU has set a target for fleet-wide average emission of new passenger cars at 95g CO2/km by 2021. The EU aims for a further 15% reduction by 2025 and a 37.5% reduction by 2030. Car manufacturers that do not comply with these emission targets will face a significant fine.

Car manufacturers accelerating electrification

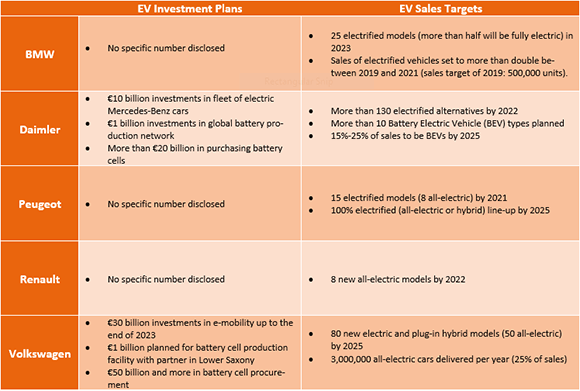

In response to these ambitious CO2 targets, European car manufacturers have begun to accelerate electrification of their vehicles. Several firms have announced their strategies and targets for electric vehicle production; Table 1 provides a brief overview.

European car manufacturers’ investment plans and sales targets for electric vehicles (EVs) [1]

Source: Company data, NN Investment Partners

Achieving these targets will require investments amounting to billions of euros in both new technologies and production facilities in the coming years. These investments should help car manufacturers move closer to low-carbon transport. We believe the green bond market represents a potentially powerful source of financing for manufacturers to achieve their EV targets and ultimately contribute to a low-carbon world.

Car manufacturers can reap the rewards of issuing green bonds

In recent years, green bonds have played a material role in financing low-carbon and climate-resilient assets and projects. Approximately 18.5% of the proceeds from green bonds is used for low-carbon transport, according to NN IP’s internal research and assessment.

Given the significant investments planned in electrification, one might also expect car manufacturers to be prominent green bond issuers. So far, however, only one euro-denominated green bond has been issued by a car manufacturer (EUR 600 million by Toyota in 2017). Toyota used the proceeds to finance the sales of Toyota and Lexus models that meet certain emissions criteria [3] in the US market.

The EU Technical Expert Group (TEG) recently published new recommendations for eligible climate-mitigation activities in the EU’s taxonomy. If the EU’s new taxonomy is implemented, only zero- or low-emission cars (less than 50g CO2/km) will be eligible for financing via green bond proceeds. Based on current technologies, only all-electric, fuel cell and certain plug-in hybrid vehicles will meet this threshold. Since many car manufacturers are launching numerous new electrified vehicle models, green bonds look like an ideal tool to finance sales of these vehicles.

As well as financing sales of electric vehicles, we have identified three ways that car manufacturers could use the proceeds from green bonds to support low-carbon transport.

Dedicated EV production platform

Given the complexity of components and differences between models, manufacturing a car is a very complicated process. Car manufacturers have long used the same production lines to manufacture diverse models and powertrains. As a result, car manufacturers cannot easily identify the capital expenditure directly related to the production of low- or zero-emission vehicles.

However, some car manufacturers are now building dedicated production platforms for new electric vehicles (including Volkswagen’s MEB and Daimler’s Electric Vehicle Architecture). This development will enable car manufacturers to identify projects related to production of low- or zero-emission vehicles. These would qualify as low-carbon and climate-resilient projects, making them eligible for financing from green bonds.

Charging infrastructure

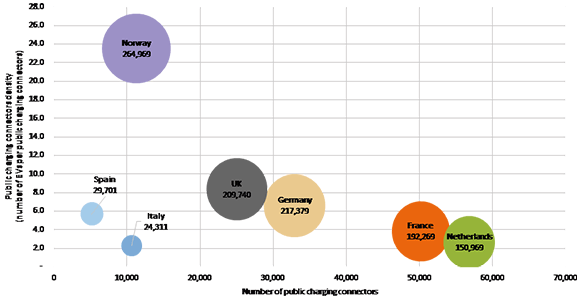

Insufficient public charging infrastructure remains a key challenge in increasing the penetration of electrified vehicles. Figure 1 shows that the density level of public charging connectors differs significantly between European countries. According to Bloomberg NEF, at end-2018, there were 7.9 EVs on the road per public charging outlet globally. Given the strong growth rate of EVs, this ratio has been increasing in recent years. To maintain the ratio at a reasonable level, Bloomberg NEF expects that between 2 million and 5 million charging outlets might be needed globally (up from 632,000 at end-2018).

Number of EVs (bubble size), number of public charging connectors and charging infrastructure density

Source: Bloomberg NEF, NN Investment Partners

In addition to utility and oil companies, car manufacturers play a key role in building charging infrastructure (e.g., Ionity, a joint venture set up by German car manufacturers). Given the significant capital requirements for new charging points, car manufacturers could use green bonds to finance these investment projects.

Battery procurement, production and recycling

Batteries are still the costliest component in the electric vehicle space. Most car manufacturers outsource the production of battery cells to suppliers but develop the technologies and production capacities for battery packs in-house. The proceeds from green bonds could potentially help car manufacturers finance production of battery packs.

Furthermore, as the number of EVs increases, so too will the amount of worn-out batteries. This could have serious environmental ramifications. Battery recycling could be an effective solution to mitigate the negative impact from worn-out batteries. Car manufacturers can recycle the batteries and give them “a second life” as a way to restore energy. In our opinion, green bonds would also be an ideal tool to finance such projects.

Green bond issuance stands to benefit both manufacturers and investors

The green bond universe has significantly expanded in recent years, with a larger number of corporates entering the arena. However, financials and utilities firms clearly dominate in this field, leaving behind other sectors such as automotive manufacturers. In total, auto manufacturers and transportation groups issued less than 3% of the total amount outstanding of corporate bonds in 2019.

As the evidence shows that transport is the second-largest contributor to global greenhouse gas (GHG) emissions, the market expects car manufacturers to do their part for climate-mitigation efforts by shifting their business models to low-carbon transportation. As auto manufacturers hold a vast pool of eligible green assets, there is strong potential to finance this transition with green bonds. This would greatly enlarge and diversify the green bond space. Sustainability-focused investors would also stand to benefit, as this would lower investment barriers within the green bond universe.

At NN Investment Partners, we are committed to engaging with potential green bond issuers, particularly within emerging sectors. We regularly engage in dialogues with car manufacturers regarding their green investments, and recently spoke with a well-known German car manufacturer about green bond issuance. We have a deep-seated conviction in the power of two-sided dialogue to determine issuers’ intentions and advise them on the best market practices. We also seek to educate potential issuers about how green bond proceeds might be used and which green assets would be eligible, in order to ensure that the bonds would be truly green. With these engagement efforts, we seek to expand the green bond market and increase the diversity and greenness of available green bonds.

Bram Bos, Co-Lead Portfolio Manager Green Bonds NN Investment Partners

[1] For illustration purposes only. Company name, explanation and arguments are given as an example and do not represent any recommendation to buy, hold or sell the stock. [2] Based on analysis of EUR 200 billion worth of green bonds [3] Eligible vehicles are those which meet all three criteria described below:

- Vehicles that are gasoline-electric hybrids or alternative fuel powertrain vehicles;

- Minimum highway and city miles per gallon (MPG or MPG equivalent) of 35; and

- A US Environmental Protection Agency (“EPA”) Smog Rating of 8 or better (where 10 is the cleanest), as determined by the EPA for the purchase of a vehicle in California