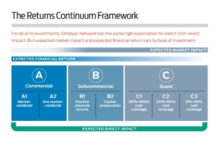

Based on $1B and 12 years of impact investing experience, Omidyar Network published a new framework to help other impact investors evaluate the financial and social impact of their investments. The report lays out a continuum that includes commercial investments, […]

lees meer

Private equity fund managers and institutional investors in Europe have joined forces to develop portfolio company-focused due diligence guidance for responsible investment, in a new initiative launched today by trade association Invest Europe. As environmental, social and governance (ESG) considerations […]

lees meer

De eerste SDE-subsidie in de najaarsronde 2016 in het kader van het stimuleren van duurzame energieopwekking werd toegekend aan het bedrijf Zonnebaan 18, een verzamelgebouw op het gelijknamige adres op het bedrijventerrein Lage Weide in Utrecht. Zonnebaan 18 is lid […]

lees meer

A new study released by CECP and supported by Prudential Financial, Inc. found that large corporations invest approximately US$2.4 billion each year in initiatives and ventures designed to achieve financial returns as well as a positive economic, social, or environmental […]

lees meer

Sustainable, responsible and impact investing assets now account for $8.72 trillion, or one in five dollars invested under professional management in the United States according to the US SIF Foundation’s biennial Report on US Sustainable, Responsible and Impact Investing Trends […]

lees meer

Het klimaatvraagstuk, de energietransitie, armoedebestrijding: de huidige grote uitdagingen vragen om een biljoeneninvestering. De bijdrage van kapitaalkrachtige institutionele beleggers, zoals pensioenfondsen en verzekeraars, groeit, al blijft het mondjesmaat. Met impact-investeringen willen ze een meetbaar verschil maken én rendement halen. De […]

lees meer

With the issue of how to get the private sector on board for climate financing high on the agenda at COP22 in Marrakesh, the first projects of a new fund supported by the European Investment Bank (EIB) – the Catalyst […]

lees meer

On 12 November at the Global Finance Action Summit in Marrakech, the European Investment Bank’s Vice-President, Jonathan Taylor with responsibility for energy, environment and climate lending called for a renewed effort from the world’s financial institutions to make the Paris […]

lees meer

The SRI Conference Announces Moskowitz Prize Winner: Study Shows Europe’s Demand for Impact Funds Over Traditional Investments Three Times Higher Than in North America. The demand for impact investing alternatives is outstripping the available supply of such choices for investors, […]

lees meer

VBDO issued a white paper about Shareholder Engagement. Shareholder engagement concerns the use of one’s ownership position to influence the decision making of company management. In doing so, shareholders aim to increase transparency and accountability and to raise social and […]

lees meer

Door een nieuwe beleggingsmethode behoort het Delta Lloyd ESG fonds, met een belegd vermogen van ruim € 2 miljard, tot de best scorende wereldwijde aandeelfondsen op het gebied van duurzaamheid. De aanpak resulteert onder andere in een 50% beperking van […]

lees meer

Van een bio-energiecentrale in Ede, die warm water levert uit resthout aan scholen en woningen op Kenniscampus Ede tot de ombouw van mestvergisters tot innovatieve co-vergisters op de Dairy Campus in Leeuwarden. Het Nationaal Groenfonds financiert ook duurzame energieprojecten. We […]

lees meer